Vietnam Awaits FTSE Verdict on Market Upgrade

As Vietnam awaits the FTSE Russell’s verdict on its stock market classification, anticipation is steadily building. The announcement is set for Tuesday, October 10, 2023, following the close of the U.S. market. An upgrade to emerging market status could potentially open the floodgates for significant foreign investment.

Vietnam’s Stock Market Status

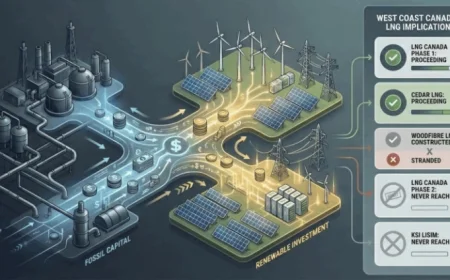

Currently labeled as a frontier market by both FTSE and MSCI, Vietnam has been striving for an upgrade to emerging market status. This reclassification could make it more appealing to institutional investors and passive funds, which often avoid frontier markets due to perceived risks.

Market Performance and Investor Concerns

Vietnam’s benchmark index has surged by 30% this year, positioning it as one of Asia’s strongest stock markets. Despite this growth, foreign investors are cautious, having sold off shares amidst concerns about exchange rate volatility and a credit boom. Both factors pose risks that could lead to asset bubbles.

Upgrade Timeline and Expectations

- Announcement Date: October 10, 2023

- Current Status: Frontier market designation since 2018

- Estimated Weight Post-Upgrade: 0.5% in FTSE Emerging Market Index

- Projected Capital Inflows: $3.4 billion from passive funds and an additional $5 billion overall, according to World Bank estimates

Vietnam’s Finance Minister Nguyen Van Thang expressed optimism regarding the potential upgrade, emphasizing the government’s ongoing market reforms. However, if approved, the actual transition may take up to six months under FTSE’s procedural guidelines.

Sector Analysis and Future Projections

The Vietnamese stock market, featuring approximately 1,600 listed companies and valued over $300 billion, has a significant presence in the FTSE frontier index. Its weight far surpasses that of counterparts like Bangladesh and Morocco, positioning it favorably for a future upgrade.

Should the FTSE grant Vietnam the upgrade, the nation would join the ranks of larger markets such as China and India, albeit with a smaller weight in the index. With an upgrade, analysts predict a positive influx of foreign capital, although some investment experts caution that the momentum could be slow.

Analyst Sentiment

Brokerage firm Mirae Asset Securities noted a drop in investor excitement over the reclassification narrative. Local equity strategists, such as Hoang Huy from Maybank Securities, suggest that negative reactions to potential delays in the upgrade are unlikely to be severe. Overall, the sentiment remains cautiously optimistic.

As the date approaches, all eyes are on Vietnam’s readiness to take a significant step forward in its financial evolution. The FTSE’s decision could pave the way for substantial capital inflows, reinforcing Vietnam’s status as an emerging market player on the global stage.