Trilogy Metals Stock Soars After U.S. Government Investment and Alaska Mining Road Revival

The Trilogy Metals stock witnessed one of its biggest rallies in years this week after the U.S. government announced a major investment and approval of a long-delayed mining road in Alaska. The decision marks a pivotal shift in U.S. critical mineral policy, aiming to strengthen domestic supply chains for copper and other essential metals used in renewable energy and defense industries.

U.S. Takes a 10% Stake in Trilogy Metals

In a surprising announcement, the Trump administration revealed that the United States government will acquire a 10% equity stake in Trilogy Metals Inc., valued at approximately $35.6 million. The deal also includes warrants allowing the U.S. to expand its ownership by an additional 7.5%, signaling strong federal support for the company’s long-term mining projects.

The investment is tied to the Ambler Road Project, a 211-mile access route that connects the remote Ambler Mining District to Alaska’s road network. This road will allow Trilogy to transport copper, cobalt, zinc, and other critical minerals from the region to processing facilities.

This move reverses a prior suspension issued under the Biden administration, which had blocked the project due to environmental and Indigenous community concerns. The decision now reopens one of North America’s most promising mineral districts.

Key Details at a Glance

| Detail | Information |

|---|---|

| Government Stake | 10% with option for +7.5% |

| Investment Amount | US$35.6 million |

| Project | Ambler Mining Road, Alaska |

| Road Length | 211 miles |

| Recent Share Surge | +138% to +214% in after-hours trading |

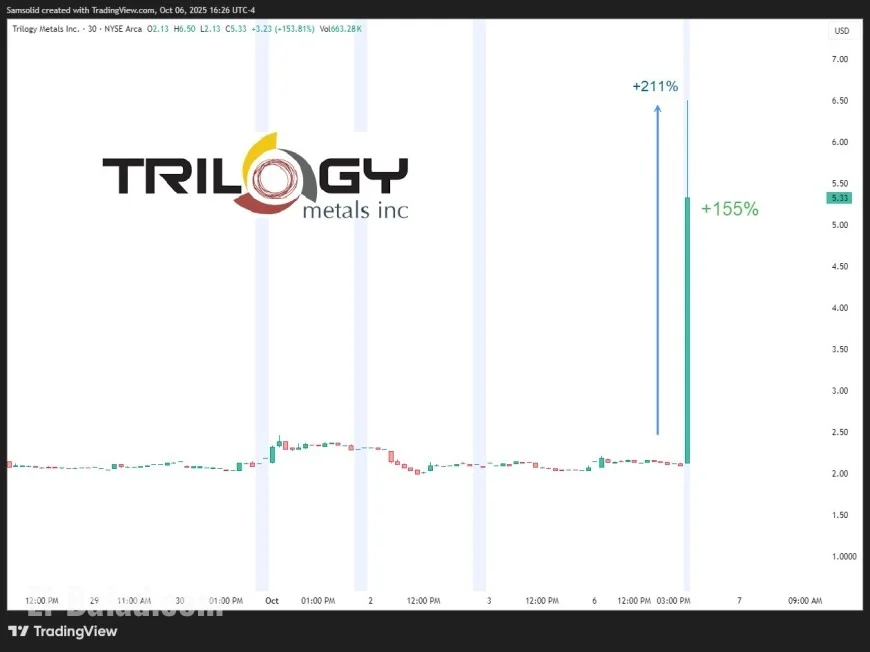

Trilogy Metals Stock Surges in Market Reaction

Investors reacted immediately to the announcement. The Trilogy Metals stock price skyrocketed in premarket trading, rising from around US$2.09 to nearly US$6 per share, a gain exceeding 200% in just hours.

Market analysts described the surge as a “rare alignment of policy and profit,” noting that the government’s involvement gives Trilogy a level of credibility and stability that few junior mining companies achieve. The move also reflects a growing U.S. strategy to secure domestic sources of metals essential for electric vehicles, batteries, and clean-energy technology.

Financial Position and Operational Updates

Before this week’s boost, Trilogy had been navigating a cautious financial period. According to its most recent quarterly report for Fiscal Q2 2025, the company held US$24.6 million in cash and US$23.8 million in working capital.

However, the company also reported a net loss of US$3.6 million earlier in the year, largely attributed to administrative costs and expenses tied to legal and regulatory activities. Trilogy’s Base Shelf Prospectus and ATM equity program allow it to raise up to US$50 million in additional funding to support exploration and infrastructure.

The company currently has 164.2 million shares outstanding, with a diluted total of 181.3 million shares, reflecting employee share units and deferred options.

Political and Environmental Reactions

The revival of the Ambler Road project has drawn both praise and criticism. Supporters argue that it will boost Alaska’s economy and reduce U.S. reliance on imported critical minerals, particularly from China. They also see it as a potential job creator in remote northern regions.

On the other hand, environmental organizations and several Indigenous groups have voiced strong opposition. They warn that the project could damage wildlife habitats and disrupt subsistence practices in nearby communities.

Despite these objections, the administration emphasized the strategic importance of the project for national security and energy independence.

Market Analysts See Long-Term Potential

Financial experts note that the U.S. stake gives Trilogy Metals a new level of security and visibility, which could attract more institutional investors. They also highlight that this move fits into a broader trend where governments are taking direct equity positions in mining firms to secure access to critical minerals.

Similar investments have been observed recently in Lithium Americas and MP Materials, both tied to the push for domestic supply chains. Analysts believe Trilogy Metals could now become a key player in that strategy.

What Comes Next for Trilogy Metals

Looking forward, much will depend on how fast construction on the Ambler Road progresses and how Trilogy manages its relationships with local communities and environmental regulators. The company must also balance its funding strategy, as future capital raises could dilute shareholder value.

Still, optimism remains high among investors. The government’s endorsement has effectively transformed Trilogy Metals stock from a speculative explorer to a national-interest asset — and that’s a narrative Wall Street rarely ignores.