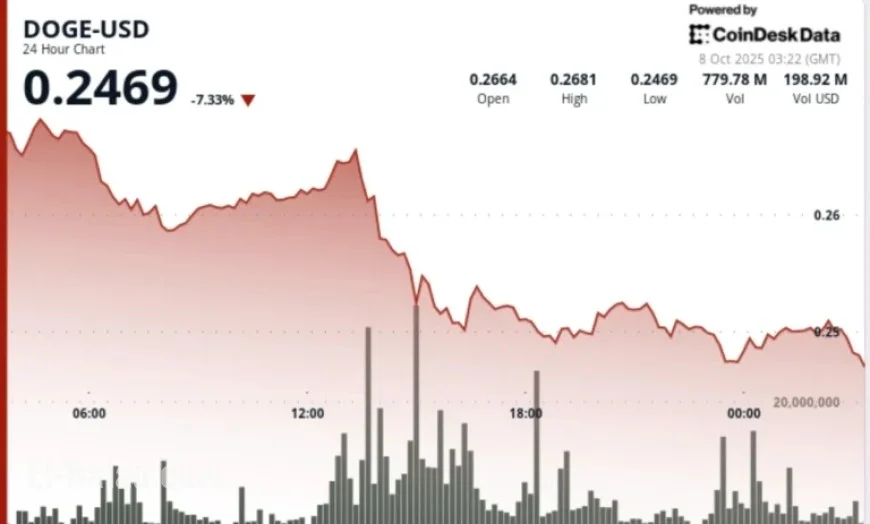

Dogecoin Drops 8% Before Whale Activity Stabilizes at $0.25

Dogecoin experienced an 8% decline in trading on Tuesday, settling around $0.25 after reaching a resistance point of $0.27. The trading session witnessed a significant liquidation wave, with over a billion tokens changing hands. However, as the day closed, it became evident that cautious investment from major players, or “whales,” was stabilizing the price.

Market Dynamics and Investor Behavior

Recent macroeconomic conditions have contributed to heightened market volatility, affecting various currencies, including cryptocurrencies. Market participants are currently contemplating a 98% likelihood of global monetary easing before the year concludes. This scenario has particularly impacted meme-coins like Dogecoin, which often react sharply to shifts in liquidity.

Institutional interest surrounds Dogecoin as high-profile firms, such as Grayscale and Bitwise, file for exchange-traded funds (ETFs) linked to the cryptocurrency. Despite a prevailing focus on Bitcoin and Ethereum, such developments keep Dogecoin relevant in broader institutional discussions.

Price Action Overview

Resistance at the $0.27 mark was reinforced, as trading volumes reached 632.9 million, forming a significant barrier for traders. The steepest price drop occurred between 13:00 and 15:00 UTC when Dogecoin fell by 5%. Nevertheless, support at the $0.25 level has displayed resilience, attracting whale interest and preventing a deeper price decline towards $0.24.

The latter part of the trading session saw Dogecoin rebound by approximately 1%, surpassing short-term resistance levels at $0.25. This recovery was characterized by consistent trades of 30 million DOGE. Observations of a double-bottom pattern indicated a potential technical base for the cryptocurrency.

Trading Statistics and Trends

- Trading Range: Notable fluctuation of $0.144, or about 4.8%, reflecting recent trading instabilities.

- Resistance Level: $0.27 remains the primary ceiling that needs to be breached for bullish momentum.

- Support Level: The $0.25 structural support is critical; a break below may test $0.24.

- Average Volume: Daily volumes around 500 million contrasted sharply with liquidation spikes exceeding 1 billion, suggesting strong distribution.

- Market Pattern: A symmetrical triangle indicates a potential breakout zone between $0.30 and $0.47.

What Traders Are Monitoring

Traders are closely observing whether the $0.25 support remains intact or could give way to a test at $0.24. Additionally, they are watching if the accumulation of 30 million DOGE signifies a bottom or if it’s merely speculative positioning before further volatility.

The impact of upcoming SEC decisions on DOGE-related ETF filings is also a critical factor influencing market liquidity and institutional strategies. Further, macroeconomic drivers, including inflation risks and easing expectations, are pivotal in shaping appetite for high-volatility assets like Dogecoin.

Lastly, the market anticipates whether Dogecoin can reclaim the $0.30 level or if it will continue to struggle beneath the current resistance.