Gold’s Historic Rally Driven by Factors Beyond Trump

The price of gold has surged to a historic peak, surpassing $4,000 per troy ounce amid global economic uncertainty. This rally highlights a significant shift, positioning gold as an “asset for all occasions.” Analysts suggest multiple factors are contributing to this historic rise.

Key Factors Behind Gold’s Historic Rally

In the past year, investors have increasingly turned to gold. Many are drawn to its status as a safe haven during turbulent economic times. Gold futures crossed the crucial $4,000 mark on a recent Tuesday, quickly followed by spot prices in Asia the next day.

Surge in Gold Prices

- Price increase of over 50% since early 2025.

- Significant price jumps observed during April trade tensions and August Federal Reserve disputes.

- Influencing events included Japan’s leadership election and political instability in both the United States and France.

Kyle Rodda, a senior analyst at Capital.com, noted that Sanae Takaichi’s victory in Japan’s Liberal Democratic Party leadership race significantly impacted this week’s price movement. Takaichi’s plans for aggressive fiscal strategies led to a decline in the yen, pushing investors towards gold.

Comparison with Previous Years

The price fluctuations of gold in recent years contrast sharply with current rates. Between June 2020 and February 2024, gold prices varied between $1,600 and $2,100 per ounce. A modest rise of about 30% occurred in 2024, but the current surge far eclipses that growth.

Historical Context of Gold’s Price Movements

Gold has not always seen such significant rallies. The 1970s, marked by prominent economic events, saw gold prices leap when the U.S. dollar was uncoupled from gold convertibility. Prices skyrocketed from $35 per ounce to $850 within a decade.

Current Market Dynamics

Unlike previous peaks, gold’s rally coincides with a performing U.S. stock market. The S&P 500 and Nasdaq achieved record highs recently, reflecting a trend of gold being viewed as a versatile investment.n Tim Waterer, chief market analyst at KCM Trade, emphasized that gold now serves dual roles as an investment asset and as a hedge against uncertainty.

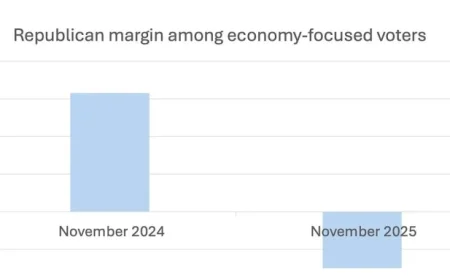

The Nuanced Role of Political Factors

While President Trump’s policies have influenced long-term gold prices, modern market dynamics reveal various drivers at work. Rodda describes gold as a “five-factor” trade, noting the impact of fiscal policies, geopolitical risks, and expectations of interest rate changes. Trump’s trade and fiscal approaches continue to shape the gold market but are just one piece of a larger puzzle.