Rescuing Bessent’s Group’s Argentine Investments

Recent developments regarding a substantial financial lifeline to Argentina have raised concerns among economists and analysts. The U.S. government has pledged $20 billion in loans to support Javier Milei’s administration amid ongoing economic turmoil.

Background on Argentina’s Economic Crisis

Argentina has a notorious track record of sovereign debt defaults, experiencing nine defaults, including three since 2001. This history highlights the nation’s struggles with corruption and fiscal mismanagement. Javier Milei, who leads the Argentine government, is attempting a controversial economic strategy centered on exchange-rate stabilization, which aims to prop up the peso and reduce inflation. However, experts like Maurice Obstfeld, a former chief economist at the International Monetary Fund, caution that such strategies have historically led to failure in Latin America.

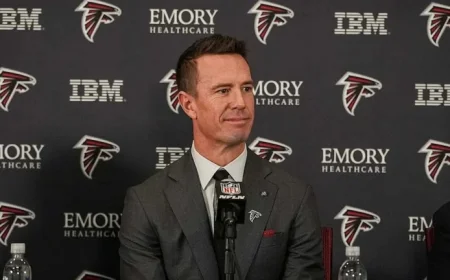

The Role of Scott Bessent

Scott Bessent, a hedge fund manager and former chief investment officer of George Soros’s fund, has been vocal about his support for Milei’s initiatives. His recent announcement of a $20 billion lifeline to the Argentine government has drawn scrutiny for its underlying motives. Critics argue that this support may primarily benefit Bessent’s hedge fund associates rather than address Argentina’s deep-rooted financial issues.

Implications of the $20 Billion Aid Package

- Argentina’s current economic policies may not be sustainable despite the influx of cash.

- Past interventions by the IMF and other investors have shown that capital often exits as soon as funds are injected.

- Investors, both domestic and foreign, may capitalize on the propping up of the peso, further destabilizing the economy.

Market Reactions and Future Prospects

As expectations for Milei’s congressional election continue to dim, investor confidence in Argentine assets appears to be waning. By September 2025, selling pressure on Argentine stocks and bonds has intensified, leading to warnings that the current strategy may ultimately fail, repeating the cycles of past crises.

Bessent’s involvement raises questions about the alignment of financial incentives. Critics suggest that his support for Milei seems more about protecting investment than providing genuine help for Argentina’s structural problems.

Conclusion

The $20 billion lifeline proposed for Argentina underlines the complex interplay of ideology, hedge fund interests, and the dire economic realities of a nation struggling to stabilize its financial future. The coming months will be critical in determining whether this assistance can lead to meaningful reform or if it simply extends a doomed strategy.