Trump Declares Inflation Conquered as Fed Lowers Interest Rates

President Donald Trump recently declared that inflation has been conquered despite recent data indicating rising prices. During a speech at the United Nations General Assembly, Trump claimed that grocery and mortgage prices are down. This assertion contrasts with the reality of inflation trends, which have shown an increase in three of the past four months.

Inflation Overview

Inflation has now risen to 2.9% in August 2023, compared to 2.6% in the same month last year, continuing to exceed the Federal Reserve’s target of 2%. Some sectors, particularly groceries, experience significant pressure. Notably, grocery prices rose by 2.7%, marking the most substantial increase outside the pandemic since 2015.

Federal Reserve’s Actions

The Federal Reserve has made notable adjustments amid rising inflation. In September 2023, the Fed cut its key interest rate as a pre-emptive measure, citing concerns about unemployment rather than inflation. Chair Jerome Powell acknowledged that inflation is still elevated but down from post-pandemic peaks.

- Inflation rate: 2.9% in August 2023

- Grocery price increase: 2.7%

- Previous inflation peak: 9.1%

Economic Implications

Critics argue that dismissing inflation could have serious consequences. Many Americans perceive high prices as a significant financial burden. This sentiment could undermine confidence in the Federal Reserve’s capability to manage inflation effectively.

Among experts, there are concerns regarding the potential long-term effects of tariffs on imported goods. Despite some economists predicting that tariffs would lead to temporary inflation spikes, it remains uncertain whether this outlook will hold.

Tariffs and Price Increases

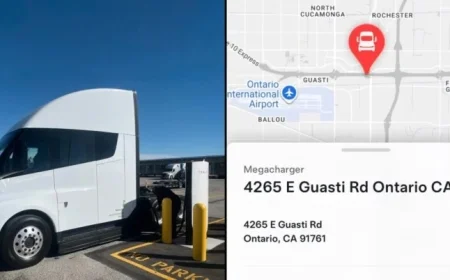

Tariffs imposed by the Trump administration, particularly on products like pharmaceuticals and kitchen cabinets, are contributing to price increases. As companies respond to rising costs, consumers may face higher retail prices.

- 100% tariff on pharmaceuticals.

- 50% tariff on kitchen cabinets.

- 25% tariff on heavy trucks.

For example, the CEO of National Tree Company stated that prices for artificial Christmas trees would rise by approximately 10% to cover tariff costs. Due to production slowdowns in China, the supply of goods like artificial trees may further tighten, hurting consumer choice and driving prices higher.

Future Outlook

Analysts highlight that maintaining credibility is crucial for the Federal Reserve. According to Jeffrey Schmid, president of the Federal Reserve Bank of Kansas City, combating high inflation that stems from a loss of confidence is particularly challenging. The situation requires careful monitoring as the Fed navigates between managing inflation and supporting employment.

Ultimately, the ongoing economic landscape presents a complex scenario. With inflationary pressures still present and the potential for consumer confidence to wane, the Federal Reserve’s decisions in the coming months will be pivotal.