Potential Fed Chief Recommends Adding These Two Assets to Your Portfolio

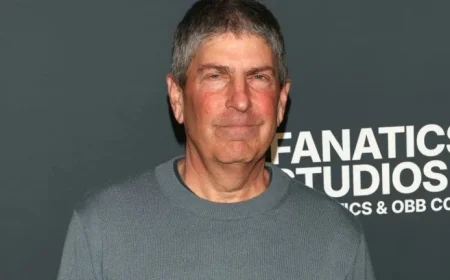

The financial landscape may soon undergo significant changes, particularly with the potential appointment of Rick Rieder as the next chairman of the Federal Reserve. Rieder, currently the chief investment officer of global fixed income at BlackRock, has emerged as a frontrunner to replace Jerome Powell when his term ends in May 2026. His understanding of macroeconomics and financial markets is notable, drawing attention from both investors and policymakers alike.

Proposed Changes Under Potential Fed Chair Rick Rieder

In mid-September, Rieder met with Treasury Secretary Scott Bessent to discuss his vision for the Federal Reserve and potential changes under his leadership. He stands out due to his advocacy for a substantial interest rate cut of 50 basis points. This recommendation resonates with some government figures, including former President Trump, who has been a vocal supporter of aggressive rate cuts.

Investment Recommendations: Gold and Bitcoin

Rieder has also provided insights into asset diversification for investors. He emphasizes the importance of including two specific assets in investment portfolios: gold and Bitcoin.

- Gold: Rieder considers gold an effective hedge against currency fluctuations. This year, the U.S. dollar has dropped over 9% against other currencies. He advises allocating 3% to 5% of investment portfolios to gold, which has surged 52% this year and recently surpassed $4,000 an ounce.

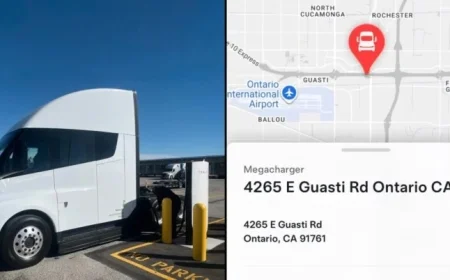

- Bitcoin: Rieder is optimistic about Bitcoin’s future, recommending a smaller portion of investments be directed towards this cryptocurrency. Currently, Bitcoin’s price is around $120,000, reflecting a 31% increase in the year 2025.

Under Rieder’s leadership, the Federal Reserve could adopt a more favorable stance towards cryptocurrencies. This would diverge from Powell’s previous cautious approach, which included branding Bitcoin as speculative. Rieder’s willingness to embrace digital currencies aligns with the Trump administration’s vision of making the U.S. a leader in the cryptocurrency domain.

Potential Economic Impact of Rieder’s Policies

Rieder’s intentions to cut interest rates could lead to rising inflation, currently at about 2.9%, causing concern about confidence in the dollar. Such a scenario typically drives investors toward gold, reinforcing its status as a hedge against inflation.

In conclusion, Rieder’s candidacy for Fed chair has significant ramifications for investment strategies. His recommendations for gold and Bitcoin as essential portfolio assets could shape investor actions leading into the anticipated changes at the Federal Reserve.