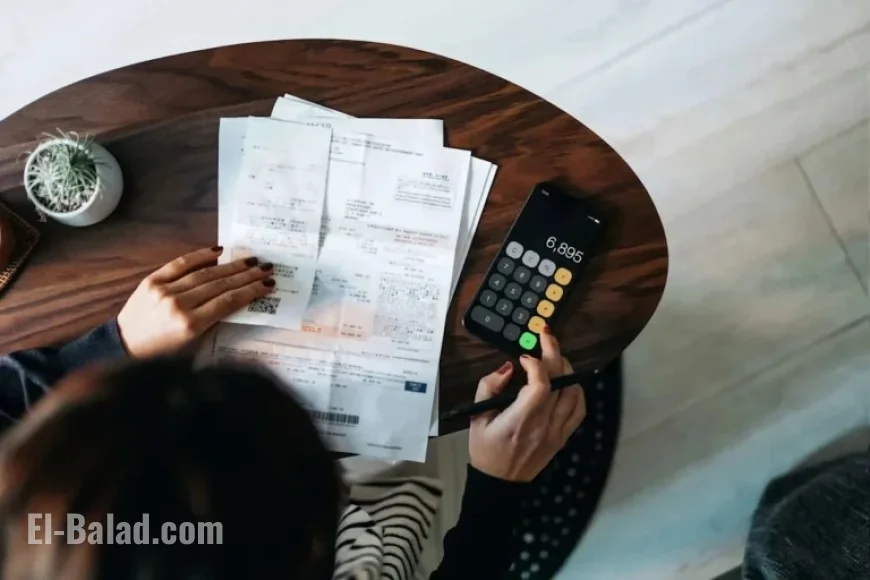

Slash Your Bills in 5 Minutes with This Simple Hack

In today’s economic climate, many consumers are facing rising prices across various services. From gym memberships to streaming platforms and utility bills, these costs can stack up quickly, often unnoticed. Here’s how to effectively manage these bills and potentially lower them in just five minutes.

Recent Price Hikes

Many popular services have increased their rates this year. Notable examples include:

- Netflix raised its monthly subscription fees.

- Comcast XFinity altered its pricing tiers for Bay Area sports channels.

- Disney+ announced a price increase coinciding with the return of Jimmy Kimmel.

These increases may appear small—often just a few dollars—but they accumulate significantly over time. For example, Netflix’s subscription cost has risen from $8 per month in 2010 to $25 for ad-free viewing today.

Utilizing Your Phone to Negotiate Bills

Your smartphone is a powerful tool for managing expenses. Calling to negotiate bills once a year can lead to better deals. This approach not only clarifies your spending but also highlights your options.

What Bills Are Easier to Negotiate?

The services that you can typically negotiate include:

- Gym memberships

- Streaming services

- Credit card companies

These organizations are often aware that consumers have multiple alternatives. Researching competitor pricing before making a call can strengthen your position. If an adjustment isn’t made, you can mention the option to switch providers.

Challenges with Essential Services

Negotiating utilities can be more complicated. Unlike other services, you usually have fewer choices for power and water, so the opportunity to switch is limited. However, many utilities offer assistance programs that may apply based on income or government benefits.

Inquiries can lead to potential discounts, payment plans, or services that help reduce monthly expenses. Additionally, homeowners might negotiate property taxes with local authorities.

How to Approach Negotiations

Direct phone interaction is most effective. While emails and online chats can be ignored, speaking to a real person usually yields better results. Here are some tips for successful negotiations:

- Be polite and to the point.

- Express your concern about recent price increases.

- Inquire about loyalty discounts or competing offers.

For example, you can say, “I noticed my subscription has increased to $X. Are there any discounts available to retain me as a loyal customer?”

Additional Tips

If you’re a student, educator, or running a small business, mention this during your negotiations as well. Credit card interest rates are particularly negotiable since lenders compete for your business. By researching online offers, you can leverage this information during your call.

Are Bill Negotiation Services Worth It?

There are apps and services that claim to help manage and negotiate bills, but caution is advised. These services often require sensitive personal information, which poses privacy risks. It is recommended that individuals manage their bills directly to avoid unnecessary fees associated with these services.

Start by reviewing your financial statements, canceling unused subscriptions, and focusing on high-cost items for negotiation. This proactive approach empowers you to take control without relying on third-party services.

Taking just five minutes to make a call can make a significant difference in your monthly budget. By understanding your options and being proactive, you can effectively combat rising bills and keep more money in your pocket.