IBM Volatility Spurs Trading System Reactions

Recent fluctuations in the stock of International Business Machines Corporation (IBM) have drawn significant attention from traders and investors alike. The company, listed on the New York Stock Exchange under the ticker symbol IBM, appears to be experiencing a mixed sentiment that could influence both short-term and long-term trading strategies.

Understanding Current Market Sentiment for IBM

The current market sentiment surrounding IBM is characterized as weak in the near term. Reports indicate that critical support levels are currently being tested. If this support holds, resistance levels may soon come into play.

Key Price Points and Projections

Investors should pay attention to several significant price points:

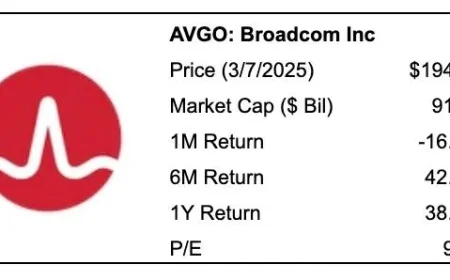

- Current Price: $251.69

- Support Level: $274.55

- Resistance Level: $298.46

An analysis shows an impressive risk-reward setup at a ratio of 30.3:1. This scenario presents a potential gain of 8.7% against a risk of just 0.3%.

Trading Strategies Based on AI Insights

Various institutional trading strategies have been developed using advanced AI models. These strategies are adapted to cater to different risk profiles and time horizons, facilitating optimized position sizing while effectively managing drawdown risks.

Multi-Timeframe Signal Analysis

Here’s a breakdown of the signal strengths over various time frames:

| Time Horizon | Signal Strength | Support Signal | Resistance Signal |

|---|---|---|---|

| Near-term (1-5 days) | Weak | $280.01 | $287.08 |

| Mid-term (5-20 days) | Strong | $285.20 | $294.58 |

| Long-term (20+ days) | Strong | $274.55 | $298.46 |

Positive sentiment is prevailing in the longer-term outlook, which remains strong across the mid and long-term scopes. This could mean favorable conditions for potential investors prepared to navigate current market volatility.

In conclusion, the trading system reactions to IBM’s volatility highlight important support and resistance levels. Understanding these dynamics can guide strategic investment decisions in this ever-changing market environment.