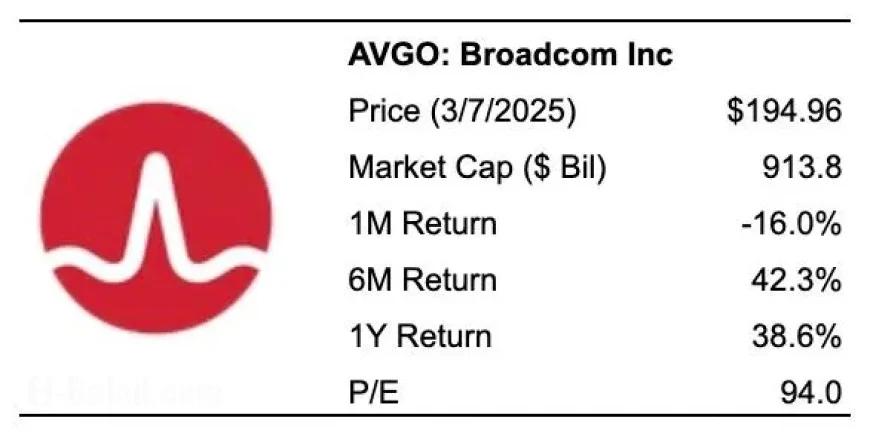

AVGO stock soars as OpenAI taps Broadcom for custom AI chips, unleashing 10GW infrastructure plan

Stock market information for Broadcom Inc (AVGO)

- Broadcom Inc is a equity in the USA market.

- The price is 357.26 USD currently with a change of 32.63 USD (0.10%) from the previous close.

- The latest open price was 352.96 USD and the intraday volume is 29911699.

- The intraday high is 371.26 USD and the intraday low is 332.9 USD.

- The latest trade time is Monday, October 13, 20:15:06 +0300.

Broadcom’s AVGO stock ripped higher on Monday after OpenAI unveiled a sweeping partnership that elevates the chipmaker from AI beneficiary to core architect. The multi-year pact calls for the development and deployment of custom AI accelerators at unprecedented scale—10 gigawatts of compute capacity—positioning Broadcom at the center of the industry’s next build-out and sparking one of the stock’s biggest single-day pops of 2025.

AVGO stock today: price, range, and participation

The tape looked like a classic re-rating session: a gap at the open, heavy buying on dips, and a relentless push into the afternoon as volume exploded.

| Metric (Cairo time) | Intraday |

|---|---|

| Last | See live chart above |

| Day High / Low | $371.26 / $332.90 |

| Open | $352.96 |

| Volume | ~29.9M shares |

The surge extends an already strong year for AVGO and resets near-term technical levels: former resistance in the mid-$340s now acts as first support, while the low-$370s mark fresh overhead supply. For momentum traders, the message is simple—respect the trend while it holds above the breakout band.

Why the OpenAI deal matters for AVGO stock

OpenAI’s move into custom accelerators formalizes a two-pronged opportunity for Broadcom:

-

Silicon and systems co-development: Broadcom’s custom-silicon playbook and packaging expertise give OpenAI a partner capable of turning ambitious designs into manufacturable, power-efficient chips at scale.

-

Networking at hyperscale: A 10GW rollout implies colossal east-west traffic. Broadcom’s Ethernet switching and optics portfolio stands to ride alongside the accelerators, offering an alternative to proprietary interconnects and widening the revenue funnel beyond the chips themselves.

The takeaway for investors: this isn’t a one-off purchase order but a roadmap that can drive multi-year visibility across multiple Broadcom franchises.

AVGO stock: how the narrative shifts from “AI exposure” to “AI backbone”

Before today, AVGO traded as a diversified compounder with a strong AI narrative—custom ASICs, switching, and a growing software stack. With OpenAI selecting Broadcom for its next leg of compute, that narrative graduates to AI backbone provider. The 10GW target signals sustained, programmatic demand, the kind that supports capacity planning, supply commitments, and long-dated pricing frameworks. In market terms, that justifies multiple expansion: higher growth durability, better mix, and rising switching costs for a marquee customer.

Equally notable is competitive positioning. Custom silicon at this scale doesn’t erase the market for general-purpose GPUs, but it does diversify the compute menu. The more hyperscalers and AI platforms blend bespoke accelerators with off-the-shelf GPUs, the more valuable Broadcom’s “have-it-your-way” model becomes—especially when paired with high-throughput Ethernet fabrics and optical links.

What to watch next for AVGO stock

-

Deployment timeline milestones: The plan phases in beginning in 2026 and stretches for years. Investors will look for quarterly markers—pilot volumes, tape-outs, and rack-level deployments—to translate headlines into booked revenue.

-

Networking attach rates: Follow-through on switches, NICs, and optics will determine how much incremental dollar content Broadcom captures per watt of compute.

-

Customer concentration and backlog: As the OpenAI program ramps, the mix across hyperscalers and AI platforms will shape perceived risk and multiple.

-

Gross-margin cadence: Custom chips can carry different margin profiles than merchant silicon. Watch for management to guide on blended margins as volumes scale.

AVGO stock technical map after the gap

-

Support: $345–$350 (gap area) then $332–$335 (day low zone).

-

Resistance: $370–$375 (intraday supply). A decisive close above opens room for price discovery.

-

Momentum lens: As long as higher lows persist on 30–60 minute charts, dips are likely to find buyers. A breakdown below the gap zone would signal digestion rather than failure.

Risks that could blunt the rally

-

Execution complexity: Custom accelerator programs can slip on design, packaging, or power delivery, pushing revenue to the right.

-

Capex cyclicality at hyperscale: AI budgets are massive, but they’re not infinite. Any moderation in build plans would ripple through orders and lead-times.

-

Competitive responses: Incumbents in accelerators and interconnects won’t stand still; pricing and standards battles could compress returns if customers press for concessions.

AVGO stock takeaway: a multi-year AI updraft with real operating teeth

OpenAI’s 10GW blueprint turns Broadcom from a passenger to a co-pilot in next-gen AI infrastructure. For the stock, that means more than a headline pop—it introduces a credible path to sustained top-line acceleration, richer networking pull-through, and improved visibility that public markets reward. Traders have momentum at their backs; investors finally have a catalyst with duration.