Hypergrowth Stock Set to Become First $10 Trillion Giant (Not Nvidia)

Oracle: The Contender for the First $10 Trillion Company

Amidst fierce competition in the tech sector, Oracle is emerging as a strong candidate to become the first company to reach a $10 trillion market capitalization. This follows the current market leader, Nvidia, with its significant presence in the artificial intelligence semiconductor space and a market cap of approximately $4.5 trillion.

Oracle’s Market Performance

As of 2025, Oracle has witnessed a remarkable stock surge, increasing by 76% year-to-date. This positions Oracle’s market capitalization at about $835 billion, ranking it as the 12th largest company globally. In comparison, Nvidia has recorded a 36% gain this year.

Growing Demand for Cloud Solutions

One of the primary factors behind Oracle’s rapid ascent is its robust cloud infrastructure. The company provides essential services for AI workloads to major cloud computing firms, governments, and various AI entities. Remarkably, Oracle’s remaining performance obligations (RPO) have surged by 359% year-over-year, totaling around $455 billion.

Key Contracts and Future Prospects

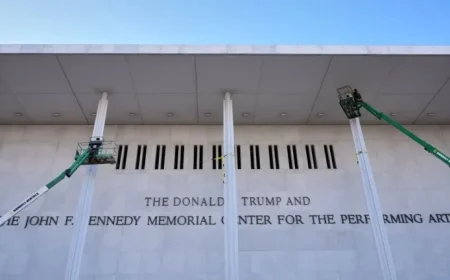

- Oracle has secured notable multi-billion-dollar contracts, including a recent five-year deal with OpenAI valued at $300 billion.

- This contract is set to take effect in 2027, potentially elevating Oracle’s RPO above $750 billion.

- The company aims to expand its multicloud database services, with plans to increase its data centers from 34 to 71.

AI and Cloud Market Growth

The AI-driven cloud computing sector is projected to generate around $3.7 trillion in revenue by 2034. As the overall cloud market nears $5.1 trillion, Oracle’s diversified offerings position it to capitalize on this growth effectively.

Revenue Predictions and Future Valuation

While Oracle experienced moderate growth in its recent fiscal quarter, the expanding revenue pipeline suggests a potential acceleration in future growth. Analysts estimate Oracle’s annual revenue could reach $645 billion by 2033, assuming a growth rate of 40% post-fiscal 2028. This optimism stems from Oracle’s current position within a fast-evolving market.

Currently trading at approximately 14 times its sales, Oracle’s valuation is expected to increase as its growth accelerates. A price-to-sales ratio of 16 would enable Oracle to achieve the coveted $10 trillion market cap, potentially surpassing Nvidia.

As competition intensifies, Oracle’s strategic initiatives and market demand will be crucial as it seeks to claim its place in history as the first company to reach a $10 trillion valuation.