China Identifies Trump’s Vulnerability

Recently, China’s Ministry of Commerce released “announcement No. 62 of 2025,” a significant policy change affecting global trade dynamics. This directive outlines new restrictions on the export of rare earths, crucial minerals that are essential for various high-tech and military applications.

China Strengthens Its Position in Global Rare Earth Market

China maintains a near-monopoly over the processing of rare earth elements, pivotal for devices ranging from smartphones to advanced military equipment. Under the current regulations, foreign companies must now seek approval from the Chinese government to export any products containing even minimal amounts of rare earths. Additionally, they are required to disclose the intended use of these products.

Heightened Tensions Between the US and China

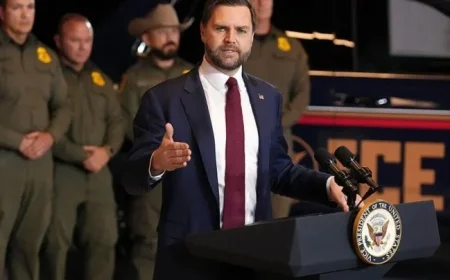

The new restrictions have escalated tensions in the ongoing trade war between the United States and China. In response to the announcement, US President Donald Trump threatened to impose additional tariffs of up to 100% on Chinese goods and to regulate exports of critical technology.

U.S. Treasury Secretary Scott Bessent characterized China’s actions as a direct threat to global supply chains, emphasizing that the world is facing a critical decision point in this trade conflict. A spokesperson from China’s Commerce Ministry countered by pointing out the US’s recent actions to suppress Chinese interests through various measures.

Impact on Supply Chains

The implications of China’s new controls are profound, as they target vulnerabilities within American supply chains. Experts predict this will disrupt negotiations scheduled later this month between President Trump and Chinese President Xi Jinping.

- Rare earths are vital for various technologies including electric vehicles and military aircraft.

- The F-35 fighter jet requires over 400 kg of rare earths for its operational components.

- China supplies approximately 70% of the world’s rare earth magnets used in electric motors for vehicles.

Potential Alternatives and Market Dynamics

While countries like Australia hold significant rare earth deposits, their processing capabilities remain underdeveloped compared to China’s. Analysts suggest that even with substantial investment, it may take years for alternatives to catch up with the efficiency of Chinese production.

Despite recent drops in rare earth exports from China—down 30% year-on-year in September—experts believe this will not severely impact China’s economy. Rare earth exports are a minor fraction of China’s total GDP, though their strategic importance offers significant leverage in trade negotiations.

Negotiation Strategies Moving Forward

US officials remain open to dialogue, expressing a willingness to negotiate a solution that could alleviate tensions. As both countries navigate these complex trade relationships, China’s latest measures could be viewed as a tactic to secure favorable outcomes in future discussions.

In summary, China’s updated export regulations on rare earths have intensified the trade tensions with the United States, underscoring the strategic significance of these minerals in global supply chains. Both nations are now at a critical juncture, where negotiations will determine the future of their economic interactions.