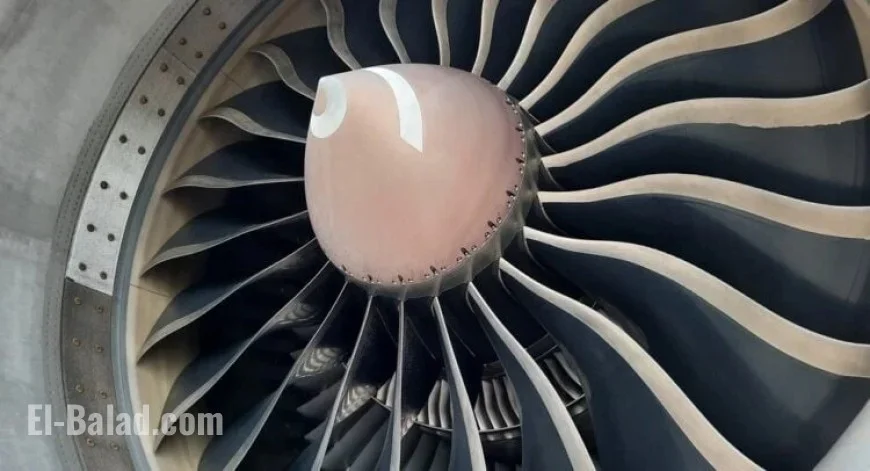

Is GE Aerospace Stock a Smart Buy Before Earnings Report?

GE Aerospace is preparing to announce its third-quarter earnings results on October 21. Investors are optimistic, with analysts predicting earnings per share of about $1.46. This marks a significant increase from last year’s $1.15 in the same quarter. Revenue expectations are strong too, estimated at approximately $10.4 billion, driven largely by high demand for commercial engines and related services.

Revenue Growth and Future Guidance

The firm has also updated its guidance for the full year of 2025. GE Aerospace anticipates mid-teens revenue growth and adjusted earnings ranging from $5.60 to $5.80 per share. This forward momentum reflects the company’s confidence in its primary segment and overall business strategy.

Nevertheless, potential challenges remain on the horizon. Key concerns include supply chain issues, uncertainties in the global economy, and the performance of GE’s defense and services divisions. However, if the company continues to receive strong orders and achieves margin increases in aerospace, it may effectively navigate these risks.

Market Expectations and Options Trading

Options traders are closely watching GE’s stock performance following the earnings report. Using advanced tools from TipRanks, it has been noted that traders anticipate a 5.3% price movement in either direction after the announcement. This expectation underscores the market’s sensitivity to the upcoming earnings release.

Analysts’ Ratings and Price Targets

- Analysts hold a Strong Buy consensus rating on GE stock.

- Nine Buys have been assigned in the last three months.

- The average price target stands at $332.22 per share, reflecting a potential upside of 9.1%.

- TipRanks’ AI forecasts an Outperform rating with a target of $346.

As the earnings report date approaches, investors remain focused on whether GE Aerospace can deliver solid results amidst current market challenges. This could be a pivotal moment for the company’s stock performance.