Student Loan Resumption Sparks Rise in Car Loan Delinquencies

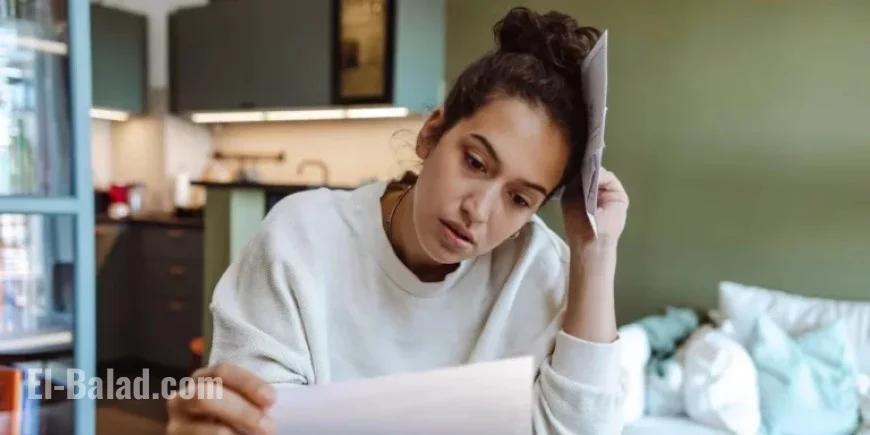

More Americans are struggling with auto loan repayments, and recent trends reveal the underlying causes. As student loan repayments resume, many borrowers are feeling the financial strain. This shift contributes significantly to increased delinquencies in car loans.

Student Loan Resumption and Financial Pressures

The return of student loan payments has affected borrowers, especially those in lower-income brackets. These individuals often face multiple financial obligations, making it challenging to manage their budgets effectively.

Impact on Auto Loan Delinquencies

Reports indicate a notable rise in car loan delinquencies coinciding with the end of the payment pause. The financial burden from resuming student loans has been a crucial factor. This situation has led to higher rates of auto loan defaults.

- Many borrowers are prioritizing student loans over car payments.

- Increased costs of living further exacerbate financial difficulties.

- Auto loan delinquencies have surged amid economic uncertainty.

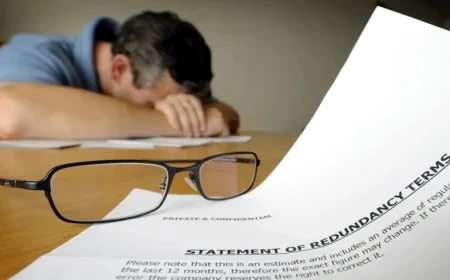

Car Repossessions on the Rise

As delinquencies increase, so do car repossessions. Financial institutions report a surge in repossession rates as more borrowers default on their auto loans.

Key Statistics

Recent analyses from various financial news outlets highlight the following:

| Statistic | Data |

|---|---|

| Increase in auto loan delinquencies | A significant percentage of borrowers |

| Rise in car repossessions | Higher rates compared to previous years |

Overall, the combination of resuming student loan payments and escalating living costs is creating a precarious financial environment. It is crucial for borrowers to reassess their budgets. Seeking assistance or financial advice may be necessary to navigate these challenging circumstances.