WBD Stock Soars to 3-Year High; Analysts Predict Paramount Takeover

Warner Bros. Discovery (WBD) has seen a significant rise in its stock prices, reaching a three-year high following reports of interest from potential buyers. On Tuesday, shares closed at $20.33, marking an 11% increase, driven by news of acquisition bids. Among the interested parties, Paramount has emerged as a strong contender.

Paramount’s Bid for WBD

Paramount’s pursuit of WBD has created speculation about a potential bidding war. Analysts consider Paramount to be the frontrunner in acquiring all or part of WBD’s assets. Doug Creutz from TD Cowen emphasized the likelihood of a transaction with Paramount, suggesting that interest from multiple buyers validates the situation.

- Stock Price Increase: WBD shares rose to $20.33.

- Percentage Increase: Shares increased by 11%.

- Potential Bidders: Paramount, Comcast, and Netflix.

Challenges for Bidders

Despite the optimistic outlook for Paramount, both Comcast and Netflix face complexities in pursuing WBD. Comcast is hindered by regulatory challenges due to its existing media assets. These include MSNBC and NBC, which have faced scrutiny from the current administration. In contrast, Paramount’s backing from influential figures, such as CEO David Ellison and his father, enhances its bidding potential.

Market Sentiment and Future Expectations

Investor sentiment around WBD has improved, particularly with the prospect of the company separating its studio and streaming operations from its cable networks by mid-2026. This strategic shift could increase the inherent value of both entities.

- Expected Date for Separation: Mid-2026.

- Stock Price Target from Bank of America: $24.

Jessica Reif Ehrlich from Bank of America stated this move could bolster the stock’s value, creating a favorable scenario for shareholders. As investment interest rises, it sets a solid foundation for future price movement.

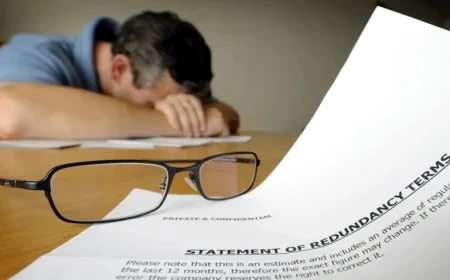

In a broader context, WBD has faced challenges since its $43 billion merger in April 2022. The company has implemented cost-cutting measures and iterated its streaming identity through brand transformations. At times, shares have dipped below $7 amid concerns over substantial debt and struggles in traditional television markets.

A Dynamic Future

Laurent Yoon from Bernstein Research noted WBD’s current strategic advantage but warned that the situation remains fluid. Maintaining multiple credible bidders will be crucial to maximizing the value of WBD’s offerings.

As negotiations unfold, the landscape surrounding Warner Bros. Discovery will be one to watch, particularly with Paramount’s strong position and the overall market unpredictability.