SAP Stock Dips Amid Revenue Shortfall and Weak Cloud Orders

SAP’s stock experienced a notable decline following the release of its third-quarter earnings report, which revealed a revenue shortfall despite a profit that exceeded estimates. The software company faces ongoing challenges, particularly with tariffs impacting its large manufacturing clients.

SAP’s Third-Quarter Financial Overview

For the quarter ending September 30, SAP reported adjusted earnings of 1.59 euros per share. This represents a 37% increase compared to the previous year. However, revenue reached only 9.076 billion euros, a 7% rise, falling short of analyst expectations of 9.11 billion euros.

Cloud Services Performance

Cloud subscriptions and support revenues rose significantly by 27%, totaling 5.29 billion euros. This figure, however, was still below the estimates of 5.328 billion euros. SAP also tracks a key financial metric known as Current Cloud Backlog (CCB), which is indicative of future revenue from customer contracts.

- CCB increased by 23% to 18.8 billion euros.

- This growth was also below the anticipated 27% increase.

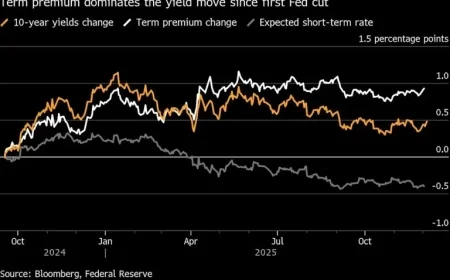

Market Reaction and Stock Performance

In after-hours trading, SAP’s stock price fell by more than 2%, settling at 269.49 euros. Over the course of 2025, the stock had shown a 14% increase up to Wednesday’s regular market session. This decline comes amid an ongoing transition from traditional software licenses to subscription-based cloud services, similar to the shift undertaken by competitors like Oracle.

Legal Challenges

Furthermore, SAP faces legal hurdles as the U.S. Supreme Court recently declined to review its appeal against a lawsuit from Teradata, which accuses the company of antitrust violations. SAP continues to forge ahead in the competitive landscape of cloud computing.

Conclusion

Despite short-term setbacks reflected in its stock dip, SAP’s shift towards cloud services positions it for potential growth. The company holds a Composite Rating of 88 out of a maximum of 99, indicating a robust standing in the market.