Wall Street Rises Despite Tesla, IBM Uncertainty and Trade Concerns

On October 23, 2023, Wall Street experienced slight increases, driven by mixed earnings results and ongoing trade tensions between the U.S. and China. Major indices showed modest gains, with the Dow, S&P 500, and Nasdaq all closing higher.

Market Performance Overview

The Dow Jones Industrial Average rose by 0.15%, finishing at 46,661.10 points. The S&P 500 increased by 0.38% to reach 6,724.57 points, while the Nasdaq Composite saw a gain of 0.67%, settling at 22,892.52 points. Despite an overall upward trend, concerns surrounding key earnings from companies like Tesla and IBM tempered market enthusiasm.

Tesla and IBM Earnings Impact

Tesla reported its third-quarter earnings, which fell short of analyst expectations. This led to a drop in its stock by as much as 5%, despite a revenue increase that provided some level of reassurance to investors. Meanwhile, IBM faced a decline of 2.5% as its core cloud software segment showed signs of a slowdown.

Tech Sector Resilience

Despite setbacks for Tesla and IBM, other technology stocks benefited from bargain-hunting activity. Members of the ‘Magnificent Seven,’ a collection of influential tech companies, showed modest gains:

- Nvidia: Up 1%

- Alphabet: Up 1%

- Amazon: Up 1%

- Meta: Up 1%

- Broadcom: Up 1.4%

Energy and Quantum Computing Gains

Energy stocks also performed well, rising by 1.4% due to an increase in crude oil prices following new U.S. sanctions against Russia. Key players like Chevron, Exxon Mobil, and Halliburton saw stock increases ranging from 1% to 2%.

In another positive development, quantum computing companies benefited from reports of potential U.S. federal investment. Companies such as IonQ and D-Wave Quantum gained 12% and 18%, respectively.

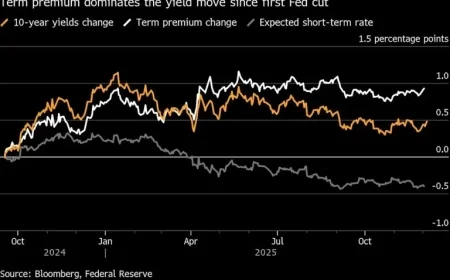

Drought of Economic Data

Investors faced a significant shortage of economic data, with the U.S. government shutdown entering its 23rd day. This uncertainty left analysts anticipating the upcoming core CPI reading, expected to remain steady at 3.1%. Market forecasts also include a potential 25-basis-point rate cut by the Federal Reserve in December.

Conclusion

As Wall Street rises cautiously amid challenging earnings reports and global trade concerns, investors will continue to monitor key economic indicators and corporate performance closely. While the earnings landscape reveals a mix of successes and challenges, overall market sentiment remains resilient in the face of uncertainty.