Target layoffs 2025: retailer cuts 1,000 corporate jobs, closes 800 open roles as “Target stock” steadies

Target confirmed a sweeping corporate restructuring that will eliminate 1,800 positions—1,000 layoffs plus 800 already-open roles that will be closed—amounting to roughly 8% of corporate headcount. The move is framed as a bid to simplify decision-making and accelerate new initiatives after a difficult stretch for sales and traffic. In early after-hours trading, Target stock hovered around the mid-$90s, showing only modest movement as investors weighed cost savings against near-term disruption.

What the Target layoffs include

-

Scope: About 1,000 corporate employees will be laid off.

-

Open roles: 800 vacancies will be eliminated rather than filled.

-

Share of workforce: Approximately 8% of corporate roles.

-

Who’s affected: Corporate teams—predominantly managerial/white-collar roles; store associates and supply-chain operations are not the focus of this round.

-

Timing & support: Impacted employees have been told pay/benefits will continue into early January, with severance and transition assistance to follow.

-

Work arrangements: U.S. corporate staff were directed to work remotely next week while notifications proceed.

The company characterized the cuts as part of a larger reset to reduce organizational layers, speed product and pricing decisions, and free up funds for customer-facing investments (including faster delivery promises and store experience updates). Leadership has consistently highlighted “complexity” as a drag on performance and agility.

Leadership backdrop: succession and strategy

Target’s corporate shake-up arrives during a planned leadership transition. Michael Fiddelke, currently chief operating officer and a long-time company veteran, is slated to become CEO on February 1, 2026, succeeding Brian Cornell, who will transition to an executive board role. Today’s restructuring aligns with Fiddelke’s push to streamline processes and sharpen merchandise value while the company contends with heavier competition in essentials and discretionary categories.

Key strategic threads to watch as the transition approaches:

-

Fewer layers, faster bets: Simplified org charts aim to cut cycle time from merchant decisions to shelf.

-

Merchandise and value: Sharper price architecture and curated newness are central to regaining share in softlines and seasonal.

-

Omnichannel pace: Investments in next-day shipping and store-fulfilled delivery are designed to defend convenience against big-box and e-commerce rivals.

-

Cost discipline: SG&A savings from the layoffs are expected to be reallocated to growth initiatives and margin repair.

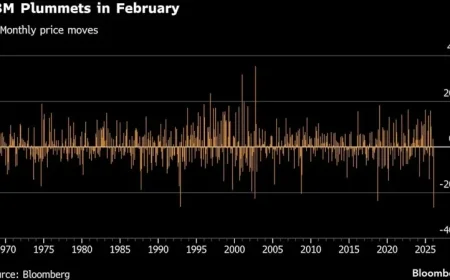

Target stock reaction and investor lens

Target stock recently traded around $94–$95, little changed on the headlines. For investors, the calculus is straightforward:

-

Positives: Immediate SG&A relief, clearer accountability, a roadmap for faster merchandising cycles.

-

Risks: Execution turbulence during notifications; potential morale hit in Minneapolis headquarters and satellite offices; savings may take time to flow through if reinvested quickly.

-

What moves the shares next: Holiday quarter sell-through, traffic trends in essentials vs. discretionary, and evidence that simplified orgs translate into cleaner in-stocks and fewer markdowns.

A muted price response suggests the market had anticipated restructuring and now wants proof that streamlined teams can convert into better comp sales and gross-margin stability.

How the Target layoffs 2025 affect teams and timelines

While store and distribution roles are not the target of this action, corporate partners should expect:

-

Decision rights clarified: Fewer review gates; more autonomy at the merchant/category level.

-

Calendar compression: Tighter go-to-market timelines for seasonal resets and brand collaborations.

-

Tech and data focus: Continued tooling for demand forecasting, allocation, and price/promo testing.

-

Holiday continuity: The company says customer-facing operations remain fully staffed heading into peak season.

For affected workers, the company has outlined severance, benefits through early January, and career support. Employees have been advised to monitor internal communications while working remotely during the notification window.

Why the cuts now—and what to watch next

The retailer has faced slowing traffic and softer discretionary demand, even as investments in convenience and private-label strength have helped defend share in essentials. The layoffs reflect a broader pivot: fewer layers, faster assortment changes, and a leaner corporate center meant to support stores and digital more directly.

Near-term checkpoints:

-

Holiday performance: Sell-through on giftables and seasonal décor; markdown discipline in January.

-

Margin signals: Promotion intensity vs. peers; freight and shrink trends.

-

Org stability: Talent retention in key merchant, supply-chain, and data roles after the reorg.

-

CEO transition milestones: Updates on 2026 leadership blueprint and capital allocation.

The Target layoffs 2025 mark a significant reset behind the scenes. If the slimmer structure speeds decisions and sharpens value without disrupting execution, Target stock could benefit from renewed operating leverage in 2026. Until then, investors will look for tangible gains in traffic, inventory health, and margin cadence to validate today’s hard choices.