CPI inflation data today: headline cools to 3.0% as rents ease and gas jumps

The latest CPI report shows U.S. consumer inflation rising 0.3% month over month in September, pushing the CPI inflation rate to 3.0% year over year. Core CPI—which excludes food and energy—rose 0.2% on the month and 3.0% over the year. The release landed at 8:30 a.m. ET and arrived slightly cooler than most forecasts, reinforcing the view that underlying price pressures are edging lower even as energy costs rebound.

CPI today: the quick numbers

-

Headline CPI (m/m): +0.3%

-

Headline CPI (y/y): +3.0%

-

Core CPI (m/m): +0.2%

-

Core CPI (y/y): +3.0%

Shelter inflation—the largest component—continued to cool at the margin, while energy flipped higher on a sharp gasoline increase. Goods prices were mixed, with apparel firmer and used vehicles softer.

What moved the inflation report

Energy and gasoline. Energy prices rose 1.5% m/m, with gasoline up 4.1%—the single biggest driver of September’s headline gain. Electricity and piped gas eased on the month, partially offsetting the pump surge.

Shelter. Overall shelter advanced 0.2% m/m. Notably, owners’ equivalent rent rose just 0.1%, the smallest monthly increase since early 2021—an encouraging signal for core services inflation as lagged rent measures keep converging toward cooler market rents.

Food. Food prices increased 0.2% m/m. Grocery categories were mixed (nonalcoholic beverages and cereals/bakery firmer; dairy softer), while food away from home ticked up modestly.

Core goods and services.

-

Apparel: +0.7% m/m

-

Used cars & trucks: -0.4% m/m

-

Motor vehicle insurance: -0.4% m/m (a welcome breather after a prolonged upswing)

-

Airline fares: +2.7% m/m

-

Recreation & household furnishings: +0.4% m/m each

Component snapshot (September, m/m)

| Category | m/m change |

|---|---|

| Headline CPI | +0.3% |

| Core CPI | +0.2% |

| Energy | +1.5% |

| Gasoline | +4.1% |

| Food | +0.2% |

| Shelter | +0.2% |

| Owners’ equivalent rent | +0.1% |

| Used vehicles | -0.4% |

| Apparel | +0.7% |

Figures are seasonally adjusted where applicable.

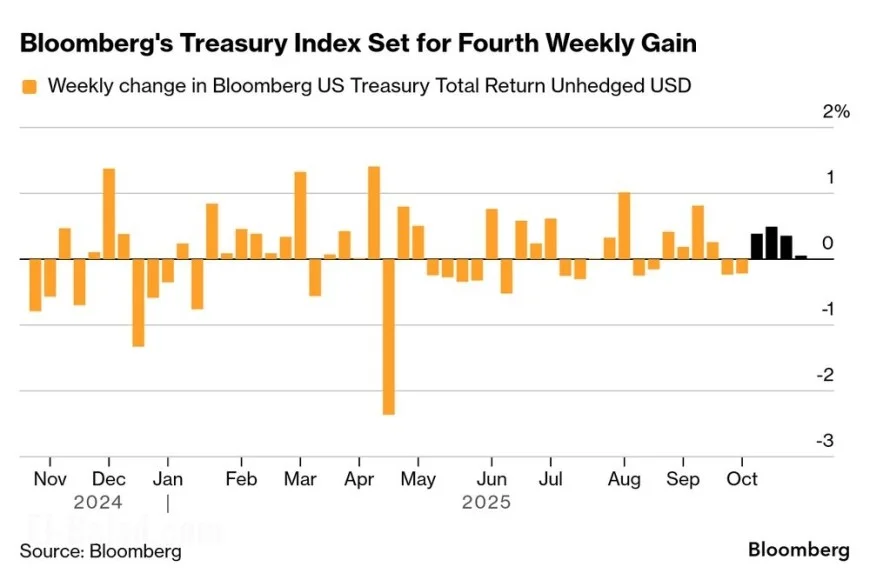

Why this CPI data matters right now

Trend check. Year-over-year headline inflation nudged up to 3.0% from 2.9% previously, but the core’s monthly step-down to 0.2% signals gradual disinflation beneath volatile energy swings. The combination—slower shelter, mixed goods, steadier services—keeps the overall path toward 2% intact, albeit unevenly.

Policy implications. A softer core print, together with cooling shelter, supports the case for additional policy easing already signaled for the near term. Policymakers will weigh today’s CPI alongside growth and labor indicators, but the mix reduces urgency to lean hawkish on transient energy spikes.

Household angle. Gas prices lifted the monthly headline, but easing rent inflation and calmer insurance/used-car dynamics should offer incremental relief in coming months. The divergence underscores why households still feel price pressure at the pump even as the broader inflation pulse fades.

Release logistics and what’s next

-

Today’s report covers September and was published on schedule.

-

Next month’s release risk: Officials have indicated that October CPI may not be published on the normal timetable if funding constraints persist, as some data collection has been disrupted. Planning assumptions should allow for potential delay.

-

Key follow-ons: Producer prices, personal consumption expenditures (including core PCE), and fresh rent-market readings will help confirm whether the shelter slowdown is durable.

How to read the CPI inflation rate from here

-

Watch shelter momentum. With owners’ equivalent rent at +0.1% m/m, further easing in core services is plausible if that pace holds.

-

Separate energy noise from core signal. Energy-driven bumps can lift the headline, but the 0.2% core is the cleaner guide for policy.

-

Goods versus services. Used cars and insurance finally cooled; if goods deflation reasserts while services drift lower, year-on-year core could slip closer to 2.5–2.7% over the medium term (directionally, not a forecast).

The CPI report today showed headline 3.0% y/y with a tame 0.2% core, a combination consistent with slow, uneven disinflation. Gasoline’s pop kept the month warm, but softer shelter and mixed core categories point to less persistent pressure underneath. Pending any schedule hiccups next month, the inflation story is bending the right way—just not in a straight line.