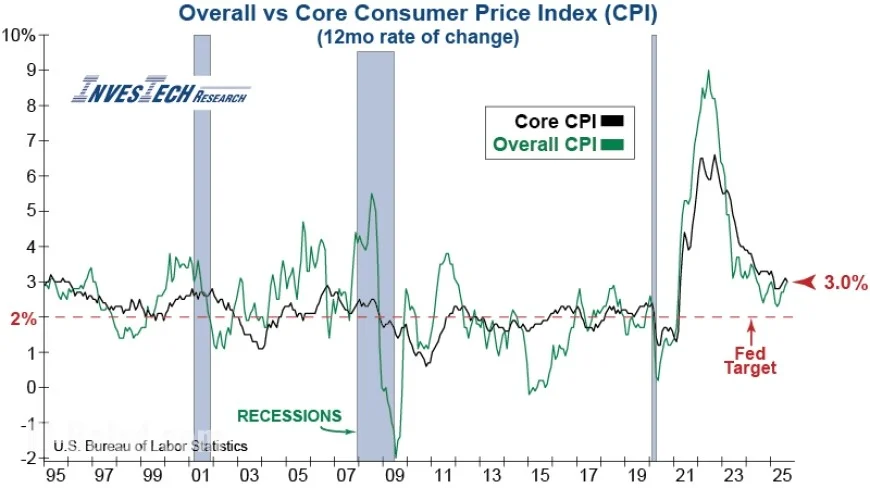

CPI Inflation Report Today: Headline Rises to 3.0% Year-Over-Year as Core Eases to 0.2% Monthly

The latest Consumer Price Index shows inflation running at 3.0% year over year in September, up slightly from 2.9% in August, while monthly headline CPI increased 0.3%. Beneath the surface, core CPI (all items less food and energy) advanced a cooler 0.2% month over month and 3.0% over the past year, signaling gradual disinflation in sticky categories even as energy costs firmed.

Key takeaways from today’s CPI data

-

Headline CPI: +0.3% m/m, +3.0% y/y

-

Core CPI: +0.2% m/m, +3.0% y/y

-

CPI-W: +2.9% y/y (often referenced in cost-of-living adjustments)

-

Energy: +1.5% m/m, +2.8% y/y; gasoline +4.1% m/m

-

Food: +0.2% m/m, +3.1% y/y; food at home +0.3% m/m; food away from home +0.1% m/m

-

Shelter: +0.2% m/m; owners’ equivalent rent +0.1% (smallest monthly increase since early 2021)

The combination—slightly hotter headline due to energy, cooler core led by shelter moderation—keeps the broader disinflation trend intact while reminding markets that progress will likely be bumpy month to month.

What moved inside the CPI basket

September’s details highlight a further step-down in several previously stubborn categories:

-

Shelter: Still the single biggest driver of core inflation, but the 0.2% m/m gain reflects continued cooling. Rent and owners’ equivalent rent both slowed, with OER posting its smallest monthly rise since January 2021.

-

Transportation & vehicles: Airline fares +2.7% m/m after a strong August; used cars and trucks −0.4%; motor vehicle insurance −0.4%.

-

Energy services: Electricity −0.5% m/m, natural gas −1.2%, partially offsetting the jump in gasoline.

-

Household & services: Recreation and household furnishings each rose 0.4% m/m; medical care +0.2% with modest increases in hospital services and prescription drugs.

Snapshot of notable monthly moves

| Category | m/m | y/y |

|---|---|---|

| Headline CPI | +0.3% | +3.0% |

| Core CPI (ex-food & energy) | +0.2% | +3.0% |

| Shelter | +0.2% | +3.6% |

| Food | +0.2% | +3.1% |

| Energy | +1.5% | +2.8% |

| Gasoline | +4.1% | −0.5% |

| Used cars & trucks | −0.4% | +5.1% |

| Motor vehicle insurance | −0.4% | — |

Monthly figures are seasonally adjusted; year-over-year comparisons are unadjusted.

Why it matters for the Fed and markets

Today’s CPI keeps inflation moving in the right direction under the hood. The 0.2% core print maps to an annualized pace near (but still above) the long-run target range if sustained. Markets typically parse three threads from a report like this:

-

Policy path: A cooler core strengthens the case for patience. Policymakers will watch upcoming readings (including PCE inflation) to confirm a downtrend before considering additional rate cuts.

-

Bond yields: Moderating shelter and softer core components can ease upward pressure on real yields, but any rebound in energy—especially gasoline—can complicate the near-term path.

-

Equities & credit: Cyclical sectors tied to travel and discretionary spending tend to welcome disinflation without outright weakness; defensives benefit if yields drift lower.

Prices consumers feel next

-

Housing costs: Slower rent and OER growth should filter into leases gradually, offering incremental relief after two years of outsized increases.

-

At the pump: Gasoline’s +4.1% m/m bounce lifted headline CPI; retail prices may stay choppy with seasonal and supply dynamics at play.

-

Groceries vs. dining out: Food at home (+0.3%) outpaced food away from home (+0.1%) on the month, a small reversal of the past year’s trend.

What’s next on the inflation calendar

Barring scheduling disruptions from federal funding constraints, the next full slate of inflation indicators—personal consumption expenditures (PCE) and the following CPI—will give a clearer read on whether September’s softer core momentum persists. Any prolonged interruption to data collection or release calendars would make it harder for policymakers and markets to assess the trajectory in real time.

The CPI inflation report today delivered a mixed but broadly encouraging message: headline ticked up on energy, core cooled to 0.2% month over month, and shelter eased further. If this pattern holds, it supports a glide path toward price stability without a sharp hit to growth. The burden now shifts to the next few prints to turn a good month into a durable trend.