Intel Foundry Business Gains Attention Amid Recovery Efforts

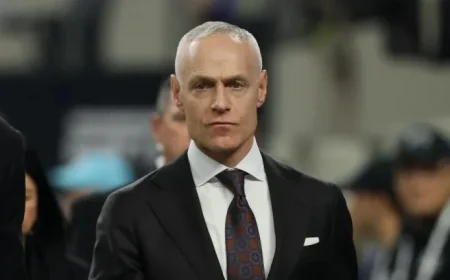

Intel Corporation showcased a remarkable recovery in its latest earnings report for the third quarter of 2023. The semiconductor giant exceeded Wall Street predictions, driven by an uptick in revenue and rigorous cost-cutting measures under CEO Lip-Bu Tan’s leadership.

Financial Highlights

In its quarterly presentation, Intel disclosed a net income of $4.1 billion, a significant improvement from a $16.6 billion loss in the same period last year. The company’s revenue increased by $800 million, rising from $12.9 billion to $13.7 billion.

Strategic Investments

Intel’s resurgence can be attributed to substantial investments totaling $20 billion during the third quarter. Key investments included:

- SoftBank: Invested $2 billion in August.

- U.S. Government: Acquired a 10% equity stake, receiving $5.7 billion of a planned $8.9 billion investment.

- Nvidia: Purchased a $5 billion stake in September as part of a collaborative chip development agreement.

- Sale of Altera Stake: Closed a deal for $5.2 billion from the sale of its interest in Altera on September 12.

Focus on Foundry Business

While Intel is making strides in recovery, its foundry business has struggled to gain traction. This segment focuses on custom chip manufacturing for various clients and has been a priority for Tan following significant layoffs in the summer.

Pivotal to the government’s investment, Intel is required to maintain its foundry operations for at least five years, signaling the importance of this sector for both the company and national interests.

Future Prospects and Strategy

Tan emphasized the importance of a disciplined approach as Intel aims to expand its foundry capabilities. The demand for semiconductors is on the rise, and Intel believes it is uniquely positioned to meet this growing need.

“Building a world-class foundry is a long-term effort founded on trust,” Tan stated. He outlined the necessity of adapting processes to serve various customer needs effectively, focusing on performance, yield, cost, and schedules.

As Wall Street watches closely, the success of Intel’s foundry business will be critical to its long-term growth strategy. The decisions made now will shape the company’s trajectory in the competitive semiconductor market.