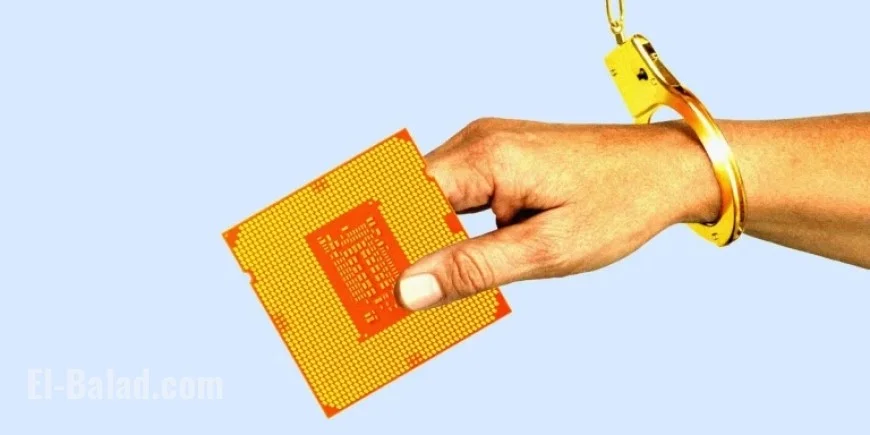

Nvidia, AMD, Broadcom Retain Talent with ‘Golden Handcuffs’ Strategy

Chipmakers are currently experiencing a significant shift in talent retention strategies, particularly through enhanced compensation packages, often referred to as “golden handcuffs.” These strategies are becoming increasingly prominent for leading companies like Nvidia, AMD, and Broadcom, as the AI sector continues to surge.

Compensation Structures and Their Impact

As valuations of chip manufacturers have soared due to heightened demand for AI technologies, employee compensation, closely tied to stock prices, has dramatically increased. Tech companies have long utilized stock incentives to retain talent. Now, as Nvidia, AMD, and Broadcom cultivate lucrative contracts, they are tightening these ‘golden handcuffs’ to keep their employees.

The Appeal of Stock Benefits

Employees are anticipating substantial payouts, with compensation packages that reward those who remain with the company over time. For example, one Nvidia employee mentioned the allure of these stock options: leaving the company before equity vests could mean significant financial loss.

According to levels.fyi, the stock value of Nvidia and Broadcom has seen exceptional growth, with many employees enjoying stock options worth millions.

Statistics and Employee Insights

The growth percentages of stock recipients have been impressive:

- Nvidia employees’ stock values have jumped over 350% since 2023.

- Broadcom employees have seen increases exceeding 300% since the same period.

An Nvidia equity package valued at $488,000 in 2023 has surged to over $2.2 million. Similarly, a modest $66,000 RSU package from Broadcom now stands at approximately $265,000. Some Broadcom employees report stock options worth over $6 million each.

This increase has created a “lottery winner syndrome,” where employees feel unable to find similarly lucrative positions elsewhere. Many are hesitant to resign, choosing instead to wait for their stock options to fully vest, leading to discussions on the possibility of early retirement among employees.

Retention Metrics at Nvidia and Broadcom

Leaders within these chip companies recognize the effectiveness of these compensation structures. Nvidia’s CEO, Jensen Huang, noted that RSUs significantly aid in retention, with turnover rates plummeting from 5.3% in 2023 to a mere 2.5% in 2025.

Broadcom also reported a global voluntary attrition rate of 6.2%, which is notably below the technology industry average. Both companies argue that their equity awards act as a “powerful long-term retention incentive.”

Adjustments to Vesting Strategies

Nvidia has adopted a front-loading vesting schedule, a method also used by firms like Google and Uber. This approach provides employees with a larger portion of their equity early on, aligning financial rewards with employee performance.

Many employees express satisfaction with their stock-based compensation, especially given the lucrative nature of stock appreciation. As current market conditions favor chipmakers, these golden handcuffs appear to be a successful strategy for retaining top talents in the tech industry.