Nvidia Stock Rises on Trump-Driven Optimism for China Blackwell Sales

Nvidia Corp. has seen its stock price soar amid excitement surrounding the potential export of its Blackwell processors to China. This boost in investor confidence follows statements made by former U.S. President Donald Trump, who indicated the upcoming discussion with Chinese President Xi Jinping about these advanced AI processors.

Nvidia’s Record Market Value on the Horizon

As of midweek trading, Nvidia’s shares reached $208.05, reflecting a 3.5% increase in premarket trading. This rise comes from a closing price of $201.03 the previous day, bringing the company’s market capitalization to approximately $4.89 trillion. To achieve a historic market value of $5 trillion, a further increase of 2.4% is needed.

Trump’s Commitment to Discussion

- Trump mentioned, “We’ll be speaking about Blackwells,” emphasizing the importance of this meeting.

- The discussions aim to ease ongoing trade tensions between the U.S. and China.

- Such an agreement could significantly reshape export policies on advanced AI technologies.

Trump’s comments have revitalized investor interest. Nvidia’s stock had already been buoyed by a series of favorable developments, including earnings that exceeded expectations and a positive outlook for chip demand.

Impact of Trade Restrictions

Since 2022, Nvidia has faced significant restrictions on selling advanced AI hardware to China. These measures were implemented due to concerns that this technology could enhance China’s military capabilities.

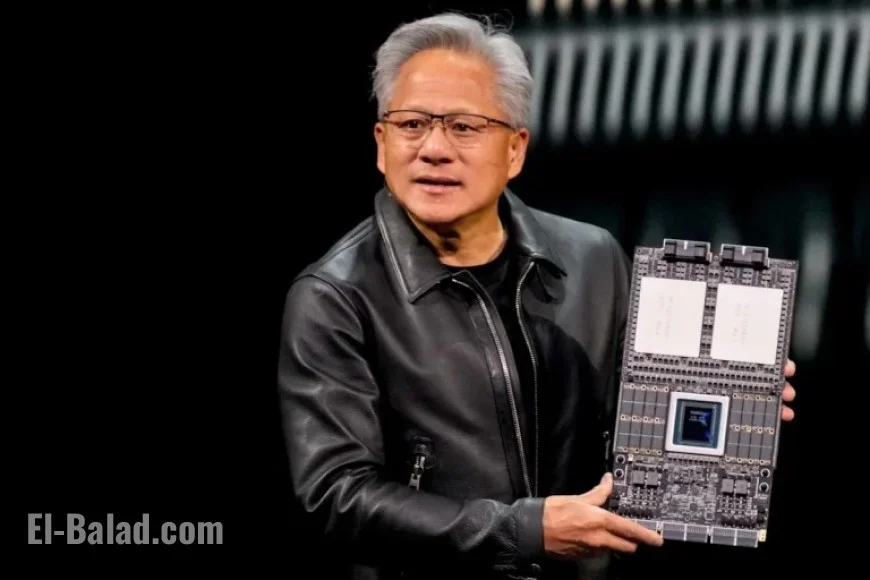

Nvidia CEO Jensen Huang noted that the company’s market share in China has plummeted from 95% to virtually zero due to these restrictions. As a proponent against such measures, he has observed how they have inadvertently boosted China’s own chip manufacturing capabilities.

Financial Stakes in the Chinese Market

- Nvidia once anticipated significant revenue from the H20 processor tailored for the Chinese market.

- However, recent restrictions have limited sales opportunities, despite the approval for some shipments.

- Chinese companies remain eager for access to Nvidia’s processors and software tools.

The Blackwell processors represent a new industrial standard, now utilized by major players like Meta Platforms Inc. and OpenAI. Gaining access to these processors could substantially enhance the technological landscape in China.

Conclusion: The Future of Nvidia in China

The upcoming U.S.-China discussions could determine Nvidia’s path forward in the lucrative Chinese market. While both Trump and Huang are optimistic, the resolution of trade tensions and restrictions remains uncertain. This uncertainty underscores the complicated dynamics of U.S.-China relations in the evolving field of artificial intelligence and semiconductor technology.