Nvidia Achieves Historic $5 Trillion Market Value Milestone

Nvidia has reached a historic milestone, becoming the first company globally to attain a market value of $5 trillion. This significant achievement highlights Nvidia’s transformation from a specialized graphics chip manufacturer to a leader in the artificial intelligence (AI) industry.

Nvidia’s Rapid Growth and Market Dynamics

The company’s journey has been remarkable. It achieved its first $1 trillion market value in June 2023, followed by a valuation of $4 trillion just three months later. Investor enthusiasm surrounding AI has significantly contributed to this surge.

On a recent Wednesday, Nvidia’s stock increased by as much as 5.6%, surpassing $212 per share. This growth is partly attributed to positive investor sentiment regarding Nvidia’s sales in China, a vital market amid ongoing geopolitical complexities.

Comparison to Competitors and Economic Impact

Nvidia now stands as the world’s most valuable company within the technology sector. Its market value eclipses the GDP of all nations except the United States and China. Moreover, it is higher than entire sectors of the S&P 500 index.

- Nvidia’s deals with top AI firms, including OpenAI and Oracle, underline its essential role in the AI boom.

- Microsoft and Apple have also recently surpassed the $4 trillion valuation mark, reflective of the broader tech sector rally.

- AI-related enterprises have driven 80% of the phenomenal gains in the stock market this year.

Concerns and Skepticism Over Valuations

Despite these impressive figures, skepticism about an AI market bubble is growing. Prominent figures, including those from the Bank of England and the International Monetary Fund, have expressed concerns regarding potential overvaluation in the tech industry.

Danni Hewson, head of financial analysis at AJ Bell, remarked that Nvidia’s $5 trillion valuation is a figure “so vast the human brain can’t properly get a handle on it.” She noted that apprehensions about an AI bubble are expected to persist.

Financial Strategies and Future Prospects

Critics question whether the rapid increase in AI tech valuations stems from “financial engineering,” with leading companies investing in each other to create a complex web of deals. Recently, OpenAI received a $100 billion investment from Nvidia.

Nvidia’s share price saw a decline in April due to market reactions to trade tensions incited by former President Donald Trump. However, the stock has since regained strength, increasing more than 50% this year alone.

- Nvidia’s access to the Chinese market remains critical, particularly as China invests heavily in its semiconductor capabilities.

- A deal struck last summer requires Nvidia to remit 15% of its Chinese revenues to the US government.

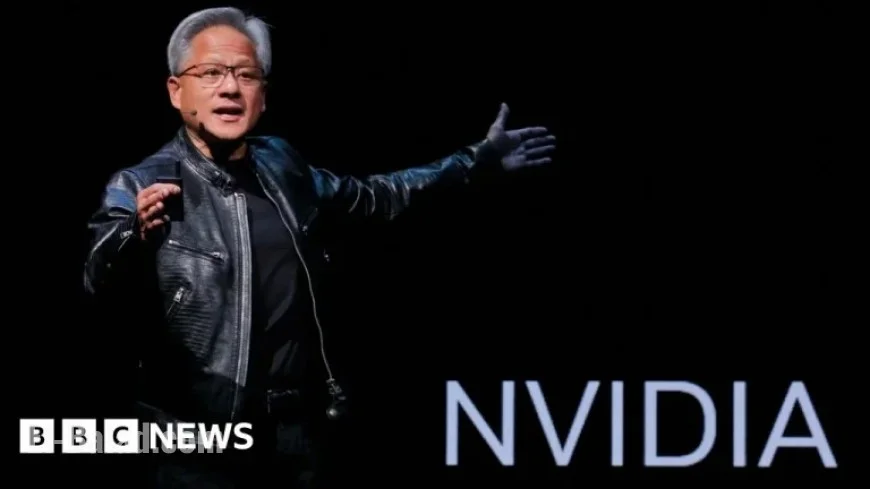

CEO’s Vision for the Future

Nvidia’s CEO, Jensen Huang, who has gained significant recognition due to the company’s success, anticipates $500 billion in AI chip orders by next year. His recent announcements of multiple partnerships have further ignited investor enthusiasm.

As Nvidia continues to dominate the headlines, its position as a crucial player in the AI market remains unchallenged, leaving many to wonder about the sustainability of this remarkable growth.