Bitcoin and Ethereum Fall as Fed Hints at Final 2025 Rate Cut

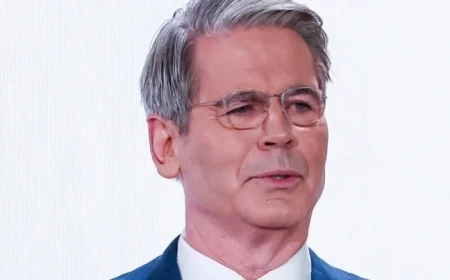

The cryptocurrency market experienced a slight dip on Wednesday following comments from Jerome Powell, the chair of the Federal Reserve. He indicated that a 25-point interest rate cut scheduled for October might be the final adjustment for 2025.

Market Performance Overview

Bitcoin fell by 1.6% over the previous 24 hours, bringing its trading price to approximately $111,000, as reported by Binance. Ethereum, ranked as the second largest cryptocurrency by market capitalization, decreased by 2%, trading a little over $3,900. The overall cryptocurrency market cap dropped by 1.8%.

Economic Commentary

During his press conference, Powell noted “strongly differing views” on future rate cuts among Federal Reserve officials. He suggested that there is an emerging consensus to pause and assess market conditions.

In traditional markets, the S&P 500 closed nearly unchanged, the Dow Jones fell by 0.2%, and the Nasdaq recorded a 0.6% gain.

Analysts’ Perspectives on Cryptocurrency Trends

Despite the market fluctuations, some analysts expressed cautious optimism. Alex Blume, CEO of Two Prime, stated that easing monetary policies could bolster upward momentum for Bitcoin, provided the macroeconomic landscape remains stable.

Recent Volatility in the Market

The recent slight decline in cryptocurrency prices was modest compared to a significant flash crash on October 10, which eradicated over $19 billion in market positions. This event was marked as the largest crypto liquidation recorded by CoinGlass.

- During the flash crash, Bitcoin lost more than $200 million in market cap and fell nearly 10% in price.

- Ethereum suffered a steeper decline, dropping almost 14%.

The downturn was triggered by former President Donald Trump’s threat to levy a 100% tariff on China, which spooked investors.

Following this event, Trump retracted his statements, assuring that relations with China would improve. “The U.S.A. wants to help China, not hurt it!!!” he stated on Truth Social, contributing to the stabilization of markets.

Current Trading Landscape

Since the October 10 crash, Bitcoin has consistently traded around $110,000, and Ethereum has hovered near $4,000. Analysts like Thomas Perfumo from Kraken emphasized that the evolving macroeconomic environment is a key factor driving the current cryptocurrency cycle.

He noted that while the market shows signs of stabilization after the significant liquidation event, it has also adjusted investors’ risk tolerance in the short term.

Traders are closely monitoring upcoming developments, including a meeting between Trump and China’s President Xi Jinping, for further market direction.