Impending Silver Tsunami Challenges Aging Population Dynamics

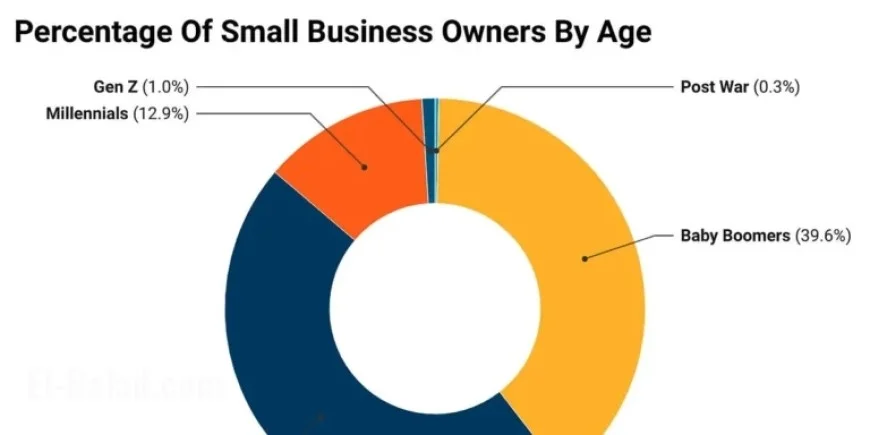

The aging population in the United States faces a significant challenge as the “Silver Tsunami” approaches. This term describes the impending transfer of business ownership as millions of baby boomers retire.

The Silver Tsunami and Baby Boomer Retirement

On a daily basis, 10,000 baby boomers reach retirement age. Many of these individuals own small businesses that serve as critical components of their local economies, including hardware stores, auto shops, and accounting firms. However, a troubling trend has emerged: fewer heirs are interested in taking over these family businesses.

Over the next two decades, approximately 3 million small business owners aged 55 and older will seek to exit their companies. This situation presents a $10 trillion opportunity as these businesses change hands. Alarmingly, nearly half of these owners lack any succession plan.

Crisis for Main Street

- Only 30% to 40% of businesses listed for sale actually find a buyer.

- The decline in interest from the younger generation poses a potential crisis for local economies.

- When these businesses close, communities lose jobs and vital local engagement.

The traditional family succession model is collapsing. Children often pursue different career paths and geographical mobility disrupts family continuity. This leaves a gap filled by inexperienced successors who may lack both the capital and interest required to operate these businesses.

Investment Opportunities Amid Crisis

Despite the challenges, there is a growing interest in entrepreneurship among Americans. Funds focused on acquiring and operating small and medium-sized businesses are gaining momentum. However, potential buyers face substantial barriers, including a lack of capital, experience, and supportive resources.

Traditional private equity (PE) strategies often overlook small businesses due to their size and the intricacies involved in transactions. Small business acquisitions demand thorough due diligence but typically generate lower profits compared to larger acquisitions. Moreover, the average small acquisition costs around $2 million, making it difficult for individuals with modest savings to secure appropriate funding.

Government Support and Historical Context

Small businesses contribute 40% to the U.S. GDP and employ over 60 million Americans. They have been pivotal in job creation, generating two-thirds of all new employment over the last 25 years. Programs such as the Small Business Administration (SBA) loans offer favorable financing options, further incentivizing investment in this space.

- The SBA’s average default rate for 7(a) loans is just 1.8%.

- Over $32 billion in loans have been approved to support small businesses since President Trump’s administration.

Implementing Solutions for Small Business Succession

Combining resources with capability is crucial. New models like Entrepreneurship through Acquisition (ETA) provide frameworks that allow skilled operators to purchase and manage small companies. However, scaling these initiatives remains challenging due to existing structural barriers.

Innovative platforms such as Mainshares are working to pair capable operators with businesses for sale, making ownership attainable for many. By leveraging technology and support systems traditionally missing from this sector, these initiatives can empower new ownership models.

Conclusion

The impending Silver Tsunami calls for immediate attention to the succession challenges facing small businesses across the country. Investors and communities must recognize the vital role these enterprises play in sustaining economic health. By supporting initiatives that promote small business ownership, we can ensure that Main Street remains vibrant and resilient for future generations.

In conclusion, by overcoming barriers and creating pathways for new entrepreneurs, America can maintain its tradition of ownership and opportunity.