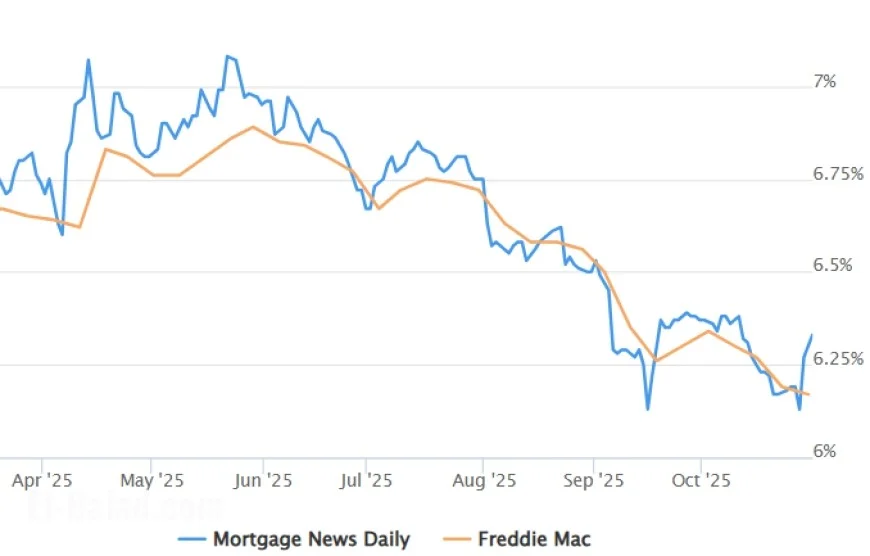

Interest rates today: Fed’s second cut sets the tone; mortgages, savings, and card APRs adjust unevenly

The interest-rate picture shifted again this week after the Federal Reserve trimmed its policy rate by 0.25 percentage point to a 3.75%–4.00% target range on Wednesday. Markets quickly repriced: Treasury yields edged around the 4% mark on the 10-year note, and headline mortgage averages slipped to fresh 13-month lows. The takeaway for households is mixed—borrowing costs are easing, but not all at once and not in every category.

Today’s snapshot: where key rates stand

-

Fed funds target: 3.75%–4.00% after the second consecutive quarter-point cut.

-

10-year Treasury yield: hovering near ~4.1%, the benchmark most closely tied to fixed mortgage pricing.

-

30-year fixed mortgage: national averages have dipped into the low-6% range; many quotes cluster around 6.2%–6.4% for strong borrowers.

-

15-year fixed mortgage: commonly ~5.4%–5.7%.

-

Home-equity lines (HELOCs): typically prime + a margin; with prime tracking the Fed, variable HELOC rates step down modestly this month.

-

High-yield savings/Money market funds: many still pay 4%–5%, but expect gradual drift lower if Treasury bills continue to ease.

-

1-year CDs: widely ~4%–5%; promotional offers will fade fastest if rate-cut expectations firm up.

-

Credit card APRs: usually variable at prime + margin, so statements should show a small decline after the Fed move—though levels remain historically high.

Actual quotes vary by credit profile, down payment, term, and lender. Check the full APR and fees.

Why mortgage rates fell faster than some other loans

Mortgages key off long-term yields and inflation expectations, not just the Fed’s short-term rate. Over the past two weeks, softer inflation data and rising odds of slower growth brought the 10-year yield down, and lenders passed part of that move into mortgage pricing. By contrast, credit cards and HELOCs track prime, which follows the Fed more directly and therefore adjusts in quarter-point increments rather than big swings.

What this means if you’re shopping a home loan

-

Purchase borrowers: The drop from the high-6s/low-7s toward the low-6s meaningfully improves affordability—several hundred dollars a month on a median mortgage. Rate locks remain prudent; volatility around data releases can whipsaw quotes.

-

Refi candidates: A broad refi wave usually needs sub-6% 30-year rates because so many owners are sitting on older 2%–4% loans. That said, cash-out or short-term refis (e.g., 15-year) can pencil out for specific goals even before 6% is breached.

Savings, CDs, and T-bill ladders: how to play the turn

Yields on high-yield savings and money market funds tend to lag both on the way up and the way down. You’ll likely see only a gradual step-down over the next couple of statement cycles. If you want to lock in income before rates slide further, consider:

-

Short-to-mid CD ladders (6–18 months): Stagger maturities to keep flexibility if inflation re-accelerates.

-

Treasury bills (4–26 weeks): Often competitive with top savings accounts and state tax-advantaged.

-

Check your existing accounts: Banks often hold legacy customers at lower yields; a quick transfer to a top-tier account can add 50–100 bps without changing risk.

Auto loans, student loans, and personal loans

-

Auto loans: Dealer financing follows both credit conditions and securitization spreads. With benchmarks easing, expect slightly better APRs, but inventory, incentives, and credit tier drive the real number.

-

Student loans: Federal rates for new loans reset annually; existing federal loans won’t change due to the Fed cut. Private variable-rate loans may tick down modestly.

-

Personal loans: Priced off risk and funding costs; strong-credit borrowers could see incremental improvement, but lenders remain cautious.

Credit cards: relief is coming—but don’t wait for it

Because card APRs are typically prime + margin, the Fed’s quarter-point cut translates to ~0.25% shaved off APRs—useful, but not life-changing when balances carry at 20%+. The biggest savings still come from paying down or consolidating:

-

Ask for a rate reduction (especially if you’ve had on-time payments for 12+ months).

-

Consider a 0% intro balance transfer—watch the transfer fee and payoff window.

-

Explore a credit union personal loan for fixed-rate consolidation.

What could move rates next

-

Labor market data: A softer jobs print would reinforce the “cuts continue, cautiously” narrative and keep long yields contained.

-

Inflation updates: Any upside surprise could stall or reverse the recent mortgage-rate relief.

-

Fed communication: Officials have signaled uncertainty about a December cut while they assess growth and inflation with imperfect data. Markets will trade on that nuance.

Practical next steps

-

Homebuyers/owners: Get two to three live quotes on the same day, ask for points vs. no-points scenarios, and compare APR, not just rate.

-

Savers: If your account yields start with a 3 while peers pay 4–5%, move. Consider locking a portion in short CDs.

-

Borrowers with variable rates: HELOC or card balances benefit from the cut—use the breathing room to accelerate principal payments.

“Interest rates today” are lower than a month ago across most benchmarks thanks to the Fed’s latest cut and easing inflation pressures. Mortgages have responded the most; savings yields will drift down more slowly; variable-rate debt should tick lower in coming cycles. If you’ve been waiting to act, this is a constructive window—but one that could narrow quickly if inflation re-firms.