Supreme Court Upholds Trump Tariffs, Officials Advise Compliance

The U.S. Supreme Court is currently deliberating on the legality of President Donald Trump’s extensive tariffs, with significant implications for trade and the economy. Established under various legal authorities, these tariffs have been a cornerstone of Trump’s trade policy and are expected to remain in place, regardless of the court’s verdict.

Supreme Court Case on Trump’s Tariffs

The Supreme Court is considering an appeal from the Trump administration following lower court decisions that ruled against the president’s approach to imposing tariffs. The courts have indicated that Trump overstepped his authority by utilizing the 1977 International Emergency Economic Powers Act (IEEPA) to enact broad tariffs, which are designed for emergency situations.

Player Perspectives

- Bill Canady, CEO of OTC Industrial Technologies, expressed concerns about the tariffs complicating supply chains, even with shifts to alternative sources like India.

- U.S. Treasury Secretary Scott Bessent anticipates the Supreme Court may uphold these tariffs. However, he has indicated the administration could pivot to alternative legal mechanisms for imposing tariffs.

- Law expert Tim Brightbill emphasized that companies must prepare for the continuation of tariff policies as a critical aspect of the economic landscape.

Legal Framework and Tariff Implications

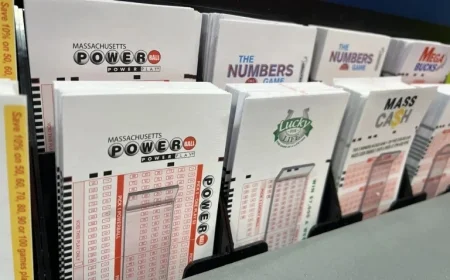

If the Supreme Court invalidates the IEEPA-based tariffs, Trump may resort to other tariff provisions. These include:

- Section 122 of the Trade Act of 1974: Allows broad tariffs of 15% for 150 days addressing trade imbalances.

- Section 338 of the Tariff Act of 1930: Facilitates tariffs up to 50% against countries that discriminate against U.S. commerce.

This multi-faceted legal approach illustrates Trump’s commitment to maintaining tariffs as a tool for economic leverage.

Trade Dynamics and Negotiations

Trump’s administration has successfully negotiated concessions from key trading partners. Recent agreements include:

- Framework trade deals with Vietnam, Malaysia, Thailand, and Cambodia.

- A $350 billion investment plan finalized with South Korea, unlocking a 15% tariff on vehicles.

Negotiations with China, however, remain challenging due to potential retaliatory actions by the Chinese government.

Economic Concerns: Revenue and Inflation

Financial markets are on edge regarding the potential impacts of a Supreme Court ruling against the tariffs. A striking down of the IEEPA tariffs could result in refunding over $100 billion collected so far this year. This revenue has been crucial in offsetting the federal deficit, which stands at approximately $1.715 trillion.

The increased cost of tariffs has mostly affected corporate profits, with companies reporting over $35 billion in added costs due to tariffs as of the third quarter of 2023.

Long-term Economic Forecast

Experts warn that the tariffs may contribute to inflation, with studies indicating they have raised consumer prices modestly. Calculated estimates suggest a 0.4 percentage point increase in the annual Consumer Price Index, contributing to inflation rates remaining above the Federal Reserve’s target.

Manufacturers might face increased pressure to reassess their production strategies, with discussions of shifting production back to the U.S. for high-end goods and maintaining operations in Mexico for lower-value components.

The ongoing legal and economic developments around Trump’s tariffs highlight the intricate relationship between trade policy, economic performance, and corporate strategy in the United States.