Bitcoin Rally Halts at $103K; 30% of BTC Supply ‘Underwater’

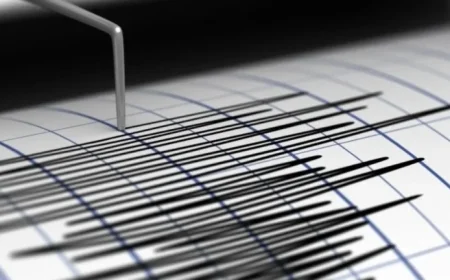

Bitcoin has recently faced significant market challenges, struggling to regain momentum after dipping below the $100,000 mark. As of Wednesday, the cryptocurrency briefly rebounded to $103,000, as traders navigated heavy losses and remained hopeful about potential whale activity to drive prices higher.

Market Dynamics and Recent Trends

Data from Cointelegraph Markets Pro and TradingView indicated a 1.5% increase in Bitcoin’s price on that day. This increase came after hitting the lowest prices since late June. Notably, Bitcoin experienced liquidations exceeding $1.7 billion in just 24 hours, according to CoinGlass.

Traders’ Perspectives

In the wake of recent market volatility, trader Skew pointed out the emergence of aggressive long positions following the previous day’s downturn. Observations indicate a strong positive delta and bid flows, particularly designed to balance out net short positioning that had occurred recently.

Signs of Market Recovery

- Aggregated spot orderbooks showed promising movements, flipping to a positive delta.

- Traders noted a significant reduction in open interest, suggesting a consolidation phase.

Trader BitBull highlighted key liquidity clusters forming at critical price points, including $102.5k, $111.5k, $116k, and $117.5k. These clusters are crucial, as they may attract whale interest and affect future price movements.

Bitcoin Supply Underwater

A concerning trend emerged as data from on-chain analytics platform CryptoQuant revealed that nearly 30% of Bitcoin’s supply is currently at a loss. This statistic implies that a substantial number of investors are underwater on their holdings even at the $100,000 threshold.

Historical Context and Implications

Despite the alarming nature of these figures, historical analysis suggests that such conditions often signal local market bottoms rather than outright breakdowns. According to contributor I. Moreno, these loss thresholds frequently align with liquidity stress points, indicating a potential for market recovery as sellers may exhaust themselves.

As traders adjust their strategies, the Bitcoin market remains in a critical phase, with both challenges and opportunities emerging amid shifting dynamics. Investors are reminded to conduct thorough research before making trading decisions.