Montreal Class Action Challenges Certain “Welcome Taxes”

A recent request for authorization to initiate a class action was filed on October 31 against the cities of Montreal, Laval, Longueuil, and Brossard. The complaint alleges that these municipalities have been miscalculating the welcome taxes, formally known as transfer duties, affecting thousands of real estate transactions.

Overview of the Welcome Tax Dispute

The core of the dispute centers on the taxation base chosen by these cities for calculating the welcome taxes. When a property transaction occurs, new buyers are imposed with transfer duties based on the highest of the following values:

- The purchase price of the property.

- The price specified in the deed of sale.

- The property’s market value, as recorded in the land assessment role.

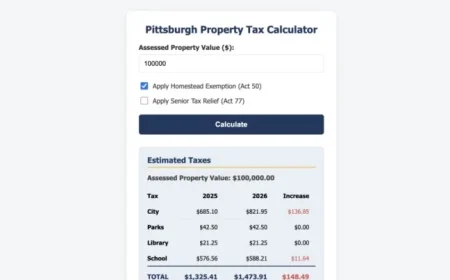

The highest value is then multiplied by a comparative factor, currently set at 1.08 in Montreal and 1 in the other municipalities involved. However, the legal action claims that the cities are basing their calculations on the land assessment role value, which is established every three years, rather than adjusting it to reflect the gradual increase in property values over time.

Gradual Increase in Property Valuation

The disputed calculations occur when municipalities choose to spread out property value increases. For instance, if a property’s value rises by $150,000 over three years, the increase can be averaged at $50,000 per year. This approach allows municipalities to avoid an immediate tax spike, but it complicates how transfer duties are assessed.

According to the attorney representing the plaintiffs, David Bourgoin, it is improper to impose transfer duties on future property values when they are not reflected in the current year’s assessment notice. He argues that buyers should not be taxed on valuations that have not yet taken effect.

Case Example: Property Purchase in Rosemont

The case includes a plaintiff, Pierre-Luc Pelletier, who purchased a property in Rosemont for $600,000 in 2024. The city assessed its value at $755,000 for the land assessment role from 2023 to 2025. Under Montreal’s resolution for spreading value increases, Pelletier’s adjusted taxable property value was recorded as $698,000 in 2024.

Because the assessed value was higher than both the actual purchase price and the deed price, the higher land value served as the basis for calculating the transfer duty. Consequently, Pelletier paid $12,074 based on the total role value. If the city had used the adjusted value, his payment would have been $10,829, resulting in an overpayment of $1,245.

Next Steps in the Legal Process

The class action is awaiting approval from a judge in the Superior Court of Quebec, who will determine whether the case is serious enough to proceed. If permitted, evidence will be presented, and a settlement could be reached before any further court hearings. Plaintiffs are automatically included in the class as long as they have faced similar issues.

While the current action only targets transactions in the specified municipalities, it could prompt similar action elsewhere. Preliminary investigations have shown that other major cities, such as Quebec City and Lévis, do not employ the same averaging method for property values.

In an earlier ruling in April 2025, the Quebec Court sided with buyers who argued that transfer duties should be calculated using adjusted taxable values. As a result, the City of Montreal had to pay $5,600 to those complainants.