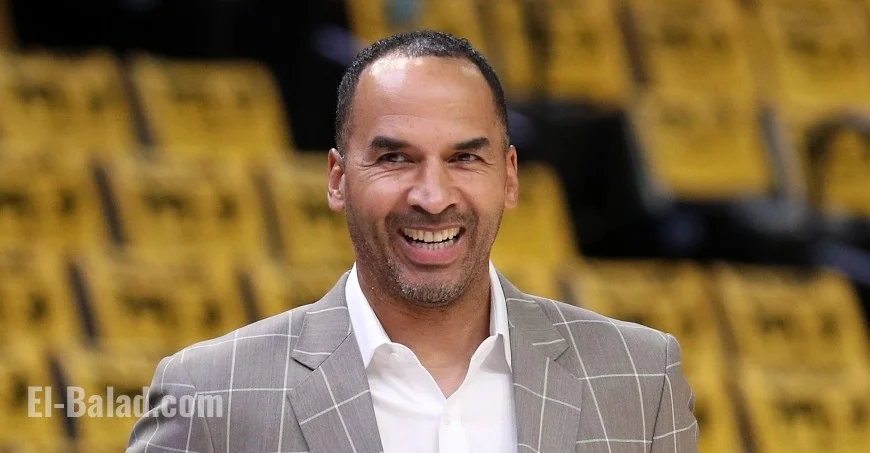

Nico Harrison on the clock: Mavericks’ 2–7 start reignites hot-seat questions and stalls any extension momentum

Nico Harrison’s future with Dallas has suddenly become a front-burner topic. After Friday’s defeat dropped the Mavericks to 2–7 and the bottom of the Western Conference, league chatter about the general manager’s job security intensified on Saturday, Nov. 8, 2025. Recent updates indicate that there have been no in-season discussions about extending Harrison’s contract, which still carries multiple years of team control. While nothing has been decided, it’s fair to say the temperature around the front office has risen.

The state of play after a 2–7 start

Two things can be true at once: Harrison oversaw a Finals run in 2024 and a series of bold, headline-dominating moves; he also presides over a roster that hasn’t coalesced through the opening nine games of 2025–26. Dallas has struggled with defensive connectivity, turnover spikes, and late-game execution, leading to repeated fourth-quarter fades. The frustration is amplified by expectations set over the summer—an emphasis on length, switchability, and complementary shooting that, to date, hasn’t translated to stable rotations or winning lineups.

The optics matter too. A fan base still processing seismic changes wants visible progress. Instead, the early record and a handful of flat home performances have reopened questions about roster balance and the long-term arc.

Contract temperature: quiet phones, louder speculation

Harrison signed a multi-year extension in June 2024, a move that rewarded the previous season’s surge and offered continuity. Sixteen months later, the environment is different. Recent reporting around the league points to no fresh extension talks this fall and an organizational posture of evaluation over action. That doesn’t guarantee a change; it does signal that ownership is content to let the season breathe before making commitments beyond the current deal.

Inside league circles, the phrase of the week has been “legitimate question” regarding Harrison’s security—a reflection of results, not a leaked decision. If Dallas steadies, the noise will fade. If losses stack up, scrutiny shifts from rotations to the architect.

How the roster got here

-

Star calculus and identity: The blueprint aimed to surround elite talent with defenders and secondary creation. Early returns show overlap in skill sets without a clear pecking order behind the top option, producing stagnant stretches.

-

Size vs. spacing tradeoffs: The bet on length has at times compressed driving lanes and bogged down half-court flow. When the three isn’t falling, Dallas has lacked easy counters.

-

Bench volatility: Rotational churn has made it hard to lock in a closing five. Bench units have yielded swing quarters that flip otherwise winnable games.

None of these issues is fatal in November, but they are interconnected—and they reflect front-office choices as much as on-court execution.

What would cool the seat quickly

-

A 10-game stabilization stretch: Even a 6–4 run would reframe the month, restore belief, and buy development time for newer pieces.

-

Defensive baseline: Holding opponents near league average over a two-week window—fewer corner threes conceded, better defensive rebounding—would validate the length/versatility thesis.

-

Cleaner late-game packages: Tighter spacing, one strong screen, and a simple second option can turn coin-flip endings into bankable wins.

-

Rotation clarity: Settling on an 8–9 man core with defined roles reduces noise and highlights what still needs a trade-deadline fix.

Decision calendar: why November matters more than it seems

Front offices do not typically make top-seat changes in early November, but informal checkpoints arrive fast:

-

Thanksgiving window: A small-sample record with underlying trends (net rating, clutch efficiency) becomes a meaningful indicator.

-

Mid-December trades: As more players become eligible to move, pressure increases to either reinforce the rotation or pivot toward longer-term flexibility.

-

January clarity: By the new year, most teams know whether they are buyers, neutral, or sellers. A sustained skid into January would force difficult conversations.

Harrison’s case will be judged across those markers, not one week. The same league voices questioning his stability now would recalibrate just as quickly if Dallas stacks wins and the numbers normalize.

The bigger picture: ownership, patience, and precedent

The organization has historically preferred measured adjustments over headline firings midstream. That bias toward stability is Harrison’s ally. The counterweight is the present record and the emotional residue from polarizing moves—when the losses pile up, goodwill evaporates faster. The path forward likely depends less on statements and more on visible, incremental improvement that matches the roster’s intended identity.

As of Saturday, no decision has been made on Nico Harrison’s future, and there’s no active extension movement. The Mavericks’ 2–7 start has made his seat warm, not yet hot, and the next four to six weeks will do most of the talking. If Dallas can defend to a league-average standard, simplify its late-game offense, and settle the rotation, the noise will recede. If not, speculation will harden into options on the table—up to and including a leadership change before the trade deadline.