Trump Suggests 50-Year Mortgages to Boost Housing Affordability

Former President Donald Trump recently hinted at a proposal for 50-year mortgages aimed at improving housing affordability. This suggestion was confirmed by Bill Pulte, Director of the Federal Housing Finance Agency (FHFA), shortly after Trump’s announcement on social media.

Details of the Proposal

Trump’s post features an image of himself alongside President Franklin Delano Roosevelt, juxtaposing a 30-year mortgage with a proposed 50-year option. Pulte remarked, “Thanks to President Trump, we are indeed working on The 50-year Mortgage – a complete game changer.” However, specifics about the proposal remain sparse, with no formal announcement yet on the White House’s press page.

Focus on Housing Affordability

Throughout his presidency, Trump has prioritized housing affordability. On his inauguration day, he issued an executive order aimed at providing emergency price relief in housing. He has also urged Federal Reserve Chair Jerome Powell to consider lowering interest rates and has initiated investigations into Fed members in pursuit of this goal.

Implications of 50-Year Mortgages

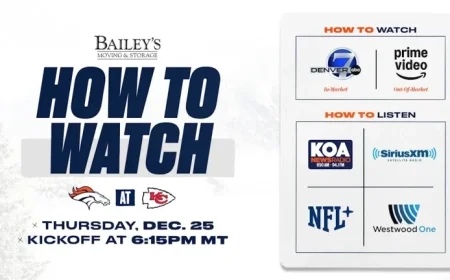

A 50-year mortgage could potentially lower monthly payments for homeowners. Here’s how different mortgage terms compare based on a mortgage rate of 6.575% and a 20% down payment:

| Home Price | 30-Year Fixed | 40-Year Fixed | 50-Year Fixed |

|---|---|---|---|

| $300,000 | $1,529 | $1,418 | $1,366 |

| $400,000 | $2,038 | $1,891 | $1,822 |

| $500,000 | $2,548 | $2,363 | $2,277 |

While a longer term reduces monthly payments, it can also lead to a decrease in homeowners’ equity. Analysts warn that extending mortgage durations may not necessarily be beneficial.

Regulatory Challenges

Currently, a significant legal barrier exists to implementing 50-year mortgages. The Dodd-Frank Wall Street Consumer Protection Act established stricter mortgage underwriting rules, making 40-year or 50-year mortgages illegal under the Qualified Mortgage (QM) standard. Changes to this regulation would be necessary for the widespread adoption of longer mortgage terms.

Expert Opinions

Industry analysts, including HousingWire Lead Analyst Logan Mohtashami, have expressed reservations about the proposal. Mohtashami believes that extending amortization periods might hinder the natural balance of the housing market, preventing necessary home price adjustments and wage growth. He stresses that the existing 30-year fixed mortgage is adequate for current housing needs.

In summary, while the proposal for 50-year mortgages could provide immediate relief for some buyers, it raises concerns about long-term equity and regulatory feasibility.