Invest $5,000 in These 2 Long-Term Tech Stocks

Investing in technology stocks can yield substantial long-term benefits. Two companies that stand out are Taiwan Semiconductor Manufacturing Company (TSMC) and Meta Platforms. Both are industry leaders with significant potential for growth, making them ideal candidates for investors seeking opportunities with a long-term horizon.

Key Insights on Taiwan Semiconductor

Taiwan Semiconductor (TSMC) is a dominant force in semiconductor manufacturing. Its products are integral to various high-tech devices, including laptops, self-driving cars, and artificial intelligence systems. Even as competitors like Nvidia, Broadcom, and AMD emerge, TSMC remains the primary source of chips for these companies.

Current Status and Market Performance

- Current Price: $286.56

- Market Capitalization: $1.486 trillion

- 52-Week Range: $134.25 – $311.37

- Forward PE Ratio: 28

- Gross Margin: 58.06%

- Dividend Yield: 0.01%

Investing in TSMC means betting on the increasing demand for advanced chips. Notably, TSMC is launching 2nm chip technology, which is expected to reduce energy consumption by 25% to 30%. This innovation is crucial as energy efficiency becomes critical in computing capacity. Although the stock is currently priced at a premium, its strategic position within the semiconductor industry justifies the valuation.

Overview of Meta Platforms

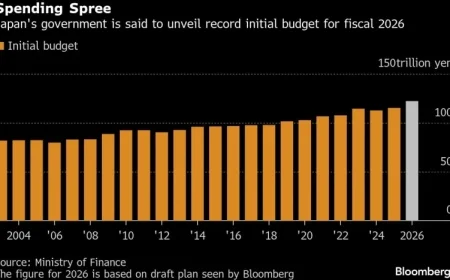

Meta Platforms operates popular social media platforms like Facebook and Instagram. Despite its attempts to diversify into hardware, Meta primarily remains an advertising business. Recent capital expenditures have raised concerns among investors, especially with projected costs reaching $70 billion to $72 billion in 2025.

Financial Growth and Market Perspectives

- Revenue Growth: 26% year-over-year to $40.6 billion

- 2024 Capital Expenditure: $39.2 billion

- 2026 Expenditure Projections: Notably larger

Despite the apprehensions surrounding its spending, Meta’s investments are aimed at harnessing more ad revenue. The market often focuses on short-term financial implications, overlooking the long-term benefits of Meta’s business strategy. This creates a buying opportunity for investors willing to be patient.

Conclusion: Invest $5,000 in These 2 Long-Term Tech Stocks

Both Taiwan Semiconductor and Meta Platforms present compelling cases for long-term investment. Their positions as leaders within their respective sectors make them advantageous options. By investing in these companies, individual investors can capitalize on emerging trends and potentially realize significant returns over time.