SoftBank’s Nvidia Sale Shakes Market, Spurs Questions

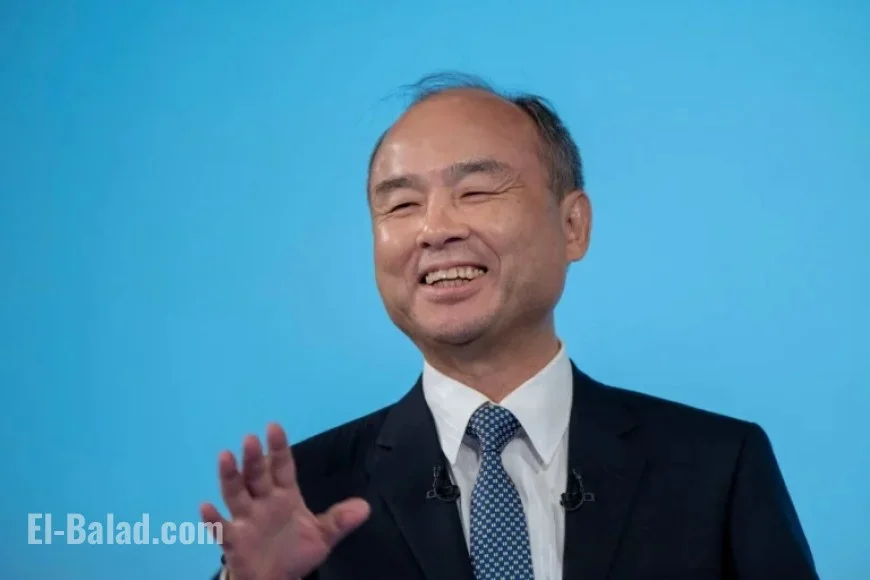

SoftBank’s recent decision to sell its entire stake in Nvidia has sent ripples through the financial markets. Founder Masayoshi Son has divested $5.8 billion in Nvidia shares, signaling a bold shift in focus towards artificial intelligence (AI).

Significance of the Nvidia Sale

This unexpected move, revealed on a recent Tuesday, underscores Son’s longstanding strategy of making audacious investments. His past maneuvers often shaped the market, making any decision he makes noteworthy.

Historical Context

- In February 2000, Masayoshi Son was the world’s richest person with a net worth of around $78 billion.

- He experienced a colossal personal loss of $70 billion during the dot-com crash that same year.

- One significant success during his career was a $20 million investment in Alibaba in 2000, which ballooned to $150 billion by 2020.

Strategic Moves and Investments

Son’s career has also seen him making controversial partnerships. In 2017, he sought $45 billion from the Saudi Public Investment Fund to launch his Vision Fund. Despite international scrutiny, he emphasized the importance of maintaining ties with Saudi investments, especially following the murder of journalist Jamal Khashoggi in October 2018.

The WeWork Disaster

SoftBank’s journey hasn’t been without its pitfalls. A significant bet on WeWork led to immense financial losses, costing the company $11.5 billion in equity and an additional $2.2 billion in debt. Son himself described the WeWork experience as “a stain on my life.”

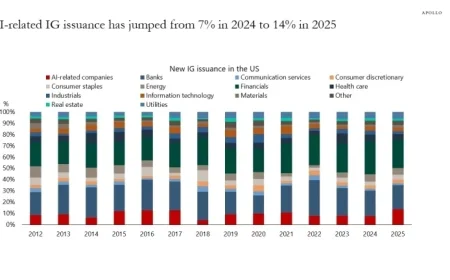

Future Directions in AI

Despite past setbacks, this latest sale is a pivotal moment in SoftBank’s strategy as it seeks to allocate resources for future ventures. The company plans a substantial $30 billion investment in OpenAI and is eyeing a $1 trillion AI manufacturing hub in Arizona.

Market Implications

- SoftBank sold 32.1 million Nvidia shares at approximately $181.58 each, 14% below Nvidia’s peak of $212.19.

- This exit marks SoftBank’s second complete withdrawal from Nvidia; the first resulted in significant losses.

The market reacted negatively, with Nvidia shares dropping nearly 3% following the announcement. Analysts suggest this sale should not be seen as a bearish move towards Nvidia but instead as a necessary step for advancing SoftBank’s AI ambitions.

Conclusion

Masayoshi Son’s history of bold investments raises questions about his vision. Investors are left wondering what insights Son might have, as he continues to navigate the complex landscape of technology and finance.