XRP Jumps 3% with Ripple Token ETF Launching at U.S. Market Open

On Thursday, the investment community anticipates significant activity with the official launch of the first U.S. spot XRP ETF. Known as XRPC, this exchange-traded fund has gained approval from Nasdaq, allowing it to enter the market. This ETF is custody managed by Gemini Trust Company and BitGo Trust Company, using the CoinDesk XRP CCIXber benchmark for accurate pricing.

XRP ETF Launch Sparks Market Momentum

The launch marks a decisive step for XRP, representing the initial expansion of spot-crypto exchange-traded products beyond Bitcoin and Ethereum. Analysts believe this event will attract institutional investors and replicate previous adoption patterns experienced in the industry.

Strong Wallet Growth

Before the ETF’s launch, the XRP network witnessed a surge of activity. Over 21,000 new wallets were created within 48 hours, showcasing the strongest growth in the past eight months. However, larger holders, referred to as whales, displayed mixed behavior, with wallets containing between 1 million and 10 million XRP offloading around 90 million tokens ahead of the launch.

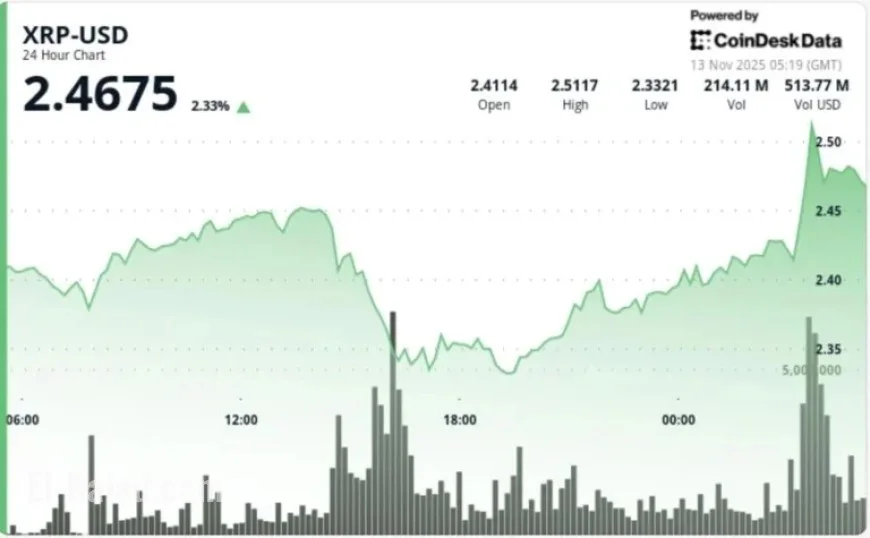

XRP Price Movement

The XRP token saw a notable increase of 3.28% to $2.48 on Wednesday, outpacing the broader cryptocurrency market. This surge followed the overcoming of a resistance level that had been in place at $2.45. Trading volume also experienced a significant increase, rising by 30.81% compared to the weekly average.

During the trading session, XRP achieved a high of $2.52, with 163 million tokens exchanged, which is approximately 143% above the typical 24-hour trading volume. Following this peak, some profit-taking occurred, bringing the price back into a consolidation range between $2.46 and $2.49.

Technical Insights

Technically, XRP maintains a positive outlook, forming an ascending channel. Recent lows have established a robust support level starting at $2.40, while key resistance is currently found at $2.52. Additional targets for potential price extensions include $2.59 and the significant psychological level of $2.70.

What Traders Should Monitor

- Support and Resistance Levels: Primary support rests at $2.40, while secondary support sits at $2.33. Resistance levels are at $2.52, followed by $2.59 to $2.70.

- Volume Trends: The recent breakout volume of 163 million XRP confirms accumulation driven by the upcoming ETF launch.

- Chart Formation: The ascending channel indicates potential breakout continuation towards $2.63 to $2.72, reflecting ETF-related inflows.

- Market Volatility: The XRPC launch is expected to drive significant volatility in the market.

- Risk Management: The bullish outlook remains intact above $2.38; however, a decline below this level could lead to a drop towards $2.33 to $2.27.

Overall, XRP’s upcoming ETF launch signifies a crucial moment not just for the token, but also for the cryptocurrency market at large. Traders remain hopeful that this event will lead to greater institutional participation and enhanced market dynamics.