Consider Investing in Nvidia Stock Before November 19

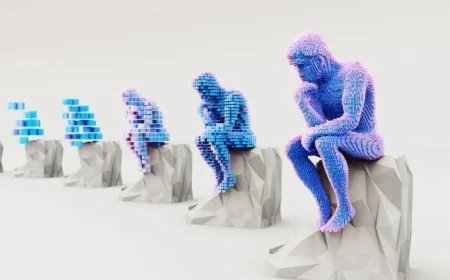

Nvidia has established itself as a leading player in the artificial intelligence (AI) sector, capturing significant attention from investors. As of November 7, Nvidia’s stock price surged 40% year-to-date, reflecting its robust performance in the market. The company’s meteoric rise began in July when it became the first to surpass a market capitalization of $4 trillion, later achieving another milestone of over $5 trillion.

Should You Invest in Nvidia Before November 19?

Investors are contemplating whether to buy Nvidia shares prior to the fiscal third-quarter results announcement on November 19. A critical aspect for potential investors to examine is Nvidia’s valuation in comparison to its semiconductor counterparts, such as AMD and Broadcom.

Nvidia’s Valuation Compared to Competitors

- Nvidia boasts the lowest price-to-earnings (P/E) ratio among its peers.

- The current P/E ratio is slightly lower than the previous year, despite the company’s considerable advancements.

- Nvidia’s earnings have seen significant growth, primarily driven by its innovative GPUs, which initially catered to gaming but have expanded their application into AI.

While a P/E ratio exceeding 50 may appear steep, it could be justified by Nvidia’s promising growth trajectory and transformative business model.

The AI Revolution and Key Investments

Nvidia’s CEO, Jensen Huang, forecasts that AI will catalyze a new industrial revolution, necessitating massive data centers, or “AI factories,” to manage workload. For instance, the U.K. government aims to ramp up its sovereign computing capacity by 20 times within five years, planning to acquire 120,000 Nvidia GPUs. OpenAI also has a commitment to purchase millions of Nvidia chips, indicating a booming market for AI accelerators.

Future Growth and Strategic Partnerships

The demand for specialized AI chips signals that Nvidia’s journey is just beginning. Following the ChatGPT launch in late 2022, the company’s earnings per share have soared. Additionally, Nvidia is shifting from enhancing graphics for video games to delivering AI solutions across various platforms.

- In October, Nvidia announced a $1 billion investment in Nokia to develop the next generation of mobile telecommunications, 6G.

- In September, Nvidia invested $5 billion in Intel, leveraging Intel’s manufacturing capabilities for chip production.

Given that Nvidia operates as a fabless chipmaker, these strategic collaborations enhance its reach within the tech ecosystem. Despite a currently high P/E ratio, Nvidia’s broad influence could lead to sustained shareholder gains in the future.

Conclusion

With Nvidia’s stock experiencing a dip of approximately 7% from its 52-week high of $212.19, now might be an opportune moment for investors to consider entering the market. Investing in Nvidia before the financial results reveal on November 19 could be a strategic decision for those looking to tap into the future of AI technology.