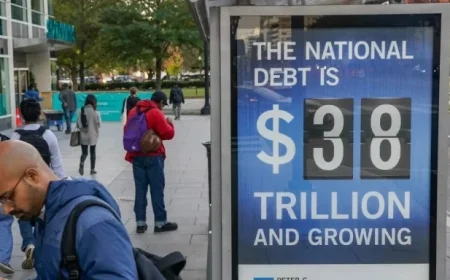

The Case for 50-Year Mortgages: A Dubious Prospect

The recent discussion surrounding 50-year mortgages has sparked a debate about their viability as a solution for home affordability. Advocates argue that longer mortgage terms could lead to decreased monthly payments, making homeownership accessible to a greater number of individuals.

The Case for 50-Year Mortgages: A Dubious Prospect

Proponents of the 50-year mortgage suggest that it could alleviate financial burdens for potential homeowners. However, this idea raises several concerns about its overall effectiveness and implications.

Understanding Mortgage Payments

One of the primary arguments for extending mortgage terms is the reduction in monthly payments. With a 50-year mortgage, homeowners would experience lower payment amounts compared to traditional 30-year loans. This could theoretically help more people enter the housing market, particularly those who currently find homeownership out of reach.

Potential Drawbacks

Despite the advantages, there are significant drawbacks to consider. Longer mortgage durations increase the total interest paid over the life of the loan. Homeowners could end up paying substantially more for their homes than if they had opted for a shorter term.

Impact on Home Equity

Another critical aspect is the effect of 50-year mortgages on home equity. Homeowners with extended terms may find it challenging to build equity quickly, which can impact their financial stability in the long run.

Alternative Solutions

- Allowing carry-over of mortgages to new homes could provide additional flexibility for buyers.

- Increasing tax-exempt gains on home sales might encourage more people to participate in the housing market.

- Implementing policies that stimulate housing supply could help lower prices naturally.

The potential benefits of a 50-year mortgage must be weighed against these concerns. While the idea offers an innovative approach to making homes more affordable, its long-term repercussions are still uncertain.

Conclusion

As the debate continues, it remains essential for policymakers to consider both the financial implications and the broader economic context. A balanced approach could lead to more sustainable solutions for addressing housing affordability in America.