FTSE 100: Tech Worries, Bitcoin Drop, and Fed Uncertainty Shape London Markets

The FTSE 100 index displayed slight resilience as it opened up 3 points at 9,701.79. Following a steep decline last Friday, the index showed minimal recovery despite previous forecasts suggesting a nine-point drop. The increase was notably influenced by WPP, which gained 5% on reports that rival Havas is evaluating parts of the company.

Market Sentiment Shift

The overall market sentiment in London is clouded by several factors, notably concerns in the tech sector, declining Bitcoin values, and uncertainties surrounding U.S. monetary policy. Investors are apprehensive as optimism for a potential U.S. rate cut in December wanes.

Concerns About Interest Rates

Jerome Powell, the Federal Reserve Chair, has indicated that another interest rate reduction is uncertain. Inflation remains above the Fed’s 2% target, contributing to increased doubts among policymakers.

Economic Uncertainty Looms

A backlog of U.S. economic data, which was delayed during a recent government shutdown, adds to the market’s uncertainty. This has left traders uneasy about the outlook for the economy moving forward.

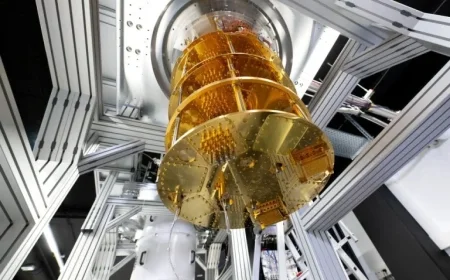

Challenges in the Tech Sector

The tech sector, which previously buoyed market performance, is now facing challenges. Concerns over high valuations are prevalent as traders await Nvidia’s upcoming earnings report, which is viewed as a critical indicator for the artificial intelligence industry.

Bitcoin’s Volatility

Bitcoin’s value has significantly decreased, briefly dropping below its end-of-2024 levels. This decline has erased all gains for the year and reflects a broader shift towards risk aversion in the investment community.

Impact of Asian Markets

Asian markets experienced declines, with Hong Kong, Shanghai, and Sydney all reporting losses. Tokyo’s market faced the steepest drops, particularly after China advised its citizens against traveling to Japan, adversely affecting retail and tourism stocks.

- FTSE 100 opened at 9,701.79

- WPP saw a 5% rise on Havas interest

- Jerome Powell reiterated uncertainties on rate cuts

- Bitcoin dipped below its end-2024 level

As the week progresses, London markets will navigate a complex landscape marked by tech worries, the ramifications of economic data, and evolving investor sentiments.