New S&P 500 Stock-Split Soars 95,000% Since IPO; Still a Buy for 2026

Netflix’s recent announcement of a stock split has generated significant interest among investors. This comes as the company aligns its growth trajectory heading into 2026, nearly 95,000% above its IPO price. The split, scheduled for November 2023, has raised questions about what this means for current and future shareholders.

Key Details on Netflix’s Stock Split

The streaming giant will execute a 10-for-1 forward stock split. Shareholders on record by November 10 will receive nine additional shares for each share they own post-trading on November 14. This stock split aims to make shares more affordable while maintaining overall market capitalization.

Understanding Stock Splits

Stock splits, like Netflix’s, do not alter the company’s fundamentals. The share price will drop to approximately one-tenth of its value, but the total investment value will remain unchanged. It allows existing shareholders easier access to shares, particularly benefiting employees with stock options.

Netflix’s Growth and Performance

Since its inception, Netflix has transformed from a DVD rental service into a global streaming powerhouse. The company went public in May 2002 and has since seen its stock price inflate by over 900% over the last decade. Its recent stock price has hovered around $1,100 per share.

- Market Cap: $47 billion

- Price Range: $110.72 – $114.27

- 52-Week Range: $80.93 – $134.12

- Volume: 48 million shares

- Average Volume: 36 million shares

Highlights from 2025 and Future Projections

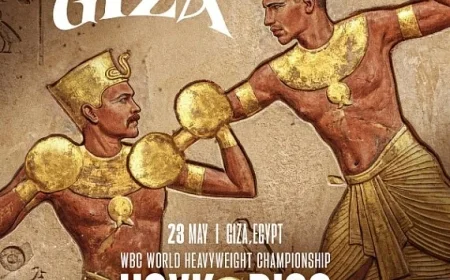

2025 has been a remarkable year for Netflix. The company has released popular content such as “KPop Demon Hunters,” accumulating 325 million views. This quarter also saw a surge in viewership for live events, including a championship boxing match that achieved over 41 million views.

Netflix’s strategic plan looks promising, with revenue expected to increase by 16% in 2026, reaching $45 billion. The operating margin is projected to rise to 29%. Analysts predict a 25% growth in earnings, further solidifying Netflix’s position in the entertainment market.

Should Investors Buy Netflix Stock?

Despite the stock split, buying or selling should not hinge on this change alone. Analysts remain optimistic about Netflix’s future, with price targets as high as $1,600 per share, equating to a potential upside of over 40% from current levels. With strong original content and an expanding advertising business, many view Netflix as a solid investment for 2026 and beyond.