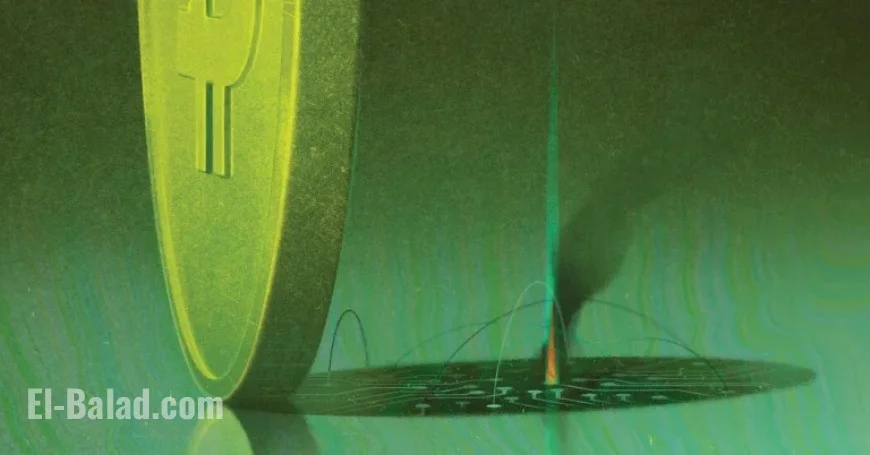

Crypto Industry Faces Scrutiny Over $28 Billion in ‘Dirty Money’

The crypto industry is facing increased scrutiny over an alarming amount of illicit funds. Recent investigations reveal that at least $28 billion linked to criminal activities has entered crypto exchanges over the past two years. This report, conducted by the International Consortium of Investigative Journalists and other media outlets, highlights the ongoing challenges of regulating the fast-evolving cryptocurrency market.

Overview of Illicit Activity in the Crypto Sector

The influx of ‘dirty money’ into crypto exchanges can be traced back to hackers, extortionists, and various cybercriminals. Notably, criminal proceeds have originated from countries like North Korea, with scams reaching as far as Minnesota and Myanmar. Major exchanges have received these funds, including Binance, the largest crypto exchange globally.

Key Findings from the Investigation

- $28 billion associated with illicit transactions has flowed into crypto exchanges in two years.

- Top exchanges involved include Binance, OKX, Bybit, and HTX.

- Binance recently faced significant legal challenges, including a $4.3 billion settlement for money laundering violations.

- Criminal activities are primarily facilitated through the anonymity and speed of crypto transactions.

Challenges in Law Enforcement

Law enforcement agencies are struggling to keep pace with the rapid rise in illicit activity in the crypto sector. Experts argue that illegal transactions often go undetected. Julia Hardy, a crypto investigation firm co-founder, emphasized the urgent need for regular monitoring and stricter enforcement measures within exchanges.

Criminal Networks and Crypto Exchanges

Recently, it has come to light that funds from criminal networks, such as the notorious Huione Group, have significantly flowed into exchanges like Binance and OKX. Huione operates as a financial conglomerate involved in laundering money for various criminal enterprises, including cyber hacks backed by North Korean groups.

Recent Statistics of Crime-Linked Transactions

| Exchange | Amount of Illicit Deposits (Last Year) |

|---|---|

| Binance | $400 million from Huione Group |

| OKX | $220 million from Huione |

| General Crypto Exchanges | $4 billion linked to scams in 2024 |

The Role of Exchanges in Money Laundering

The role of crypto exchanges in regulating and controlling the flow of illegal funds has come under scrutiny. While companies like Binance and OKX assert that they are enhancing compliance measures, issues remain. Notably, Binance’s vulnerabilities have allowed criminal organizations to exploit their platform without restraint.

Impact of Scams and Fraudulent Activities

Crypto scams, particularly those involving investment fraud, have proliferated, costing victims billions. Last year alone, such scams accounted for losses exceeding $5.8 billion. Victims often find it challenging to recover their funds, as evidenced by numerous complaints submitted to law enforcement.

In response, exchanges claim to have implemented stricter measures, including compliance programs and KYC protocols. However, the effectiveness of these measures remains debatable as individuals associated with scams continue to manipulate the systems.

Conclusion

The cryptocurrency sector faces a critical juncture as it grapples with the ramifications of rapidly increasing illicit funds. Regulatory bodies and law enforcement must work collaboratively with crypto exchanges to develop effective strategies to combat these challenges. Without improved transparency and accountability, the potential for misuse will persist, undermining the integrity of the entire crypto industry.