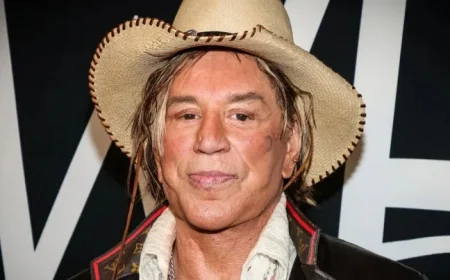

Michael Burry Criticizes Nvidia’s $112.5B Buyback as Zero Shareholder Value

Michael Burry, the renowned investor known for his influential role in the “Big Short” prediction, has raised concerns regarding Nvidia Corporation’s capital allocation strategy. He specifically critiques the tech company’s substantial $112.5 billion spent on stock buybacks since 2018, claiming it has provided “zero” additional shareholder value.

Nvidia’s Stock Buybacks: An Analysis

Burry took to social media platform X to detail his analysis of Nvidia’s financial practices. He emphasized a significant mismatch between the company’s aggressive share repurchase strategy and its increasing number of shares outstanding. Since 2018, Nvidia has allocated $20.5 billion in Stock-Based Compensation (SBC).

Despite generating a remarkable $205 billion in net income and $188 billion in free cash flow in that timeframe, Burry argues the $112.5 billion spent on buybacks was, in effect, to counteract the dilution from stock-based compensation. He pointed out that even after this extensive buyback, Nvidia has 47 million more shares available. This dilution, Burry noted, has effectively halved the earnings attributable to owners.

The Implications of Buybacks

Burry’s concerns suggest that Nvidia’s buyback expenditures were more of a defensive strategy against dilution rather than a sincere effort to lower shares outstanding. This situation complicates the concept of “owner’s earnings,” potentially misleading long-term investors about the company’s financial health.

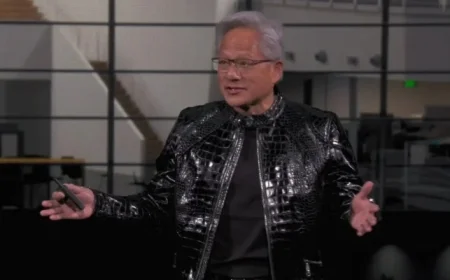

Nvidia’s Market Position

This critique arises amid Nvidia’s robust performance, fueled largely by its integral role in the booming AI sector. The company recently reported third-quarter earnings reflecting record revenue of $57 billion, marking a 62% year-over-year increase. CEO Jensen Huang declared, “AI is going everywhere,” underscoring the driving force of innovation within the organization.

Nvidia’s leadership also highlighted significant demand for their latest GPU architectures, forecasting a potential $500 billion in revenue by the end of 2026 from these technologies.

Strategic Direction and Future Plans

- CEO Jensen Huang confirmed ongoing stock buybacks.

- Nvidia will continue to make strategic investments in partnerships, including collaborations with OpenAI and Anthropic.

- The company’s CFO, Colette Kress, emphasized the necessity for a robust balance sheet to support growth and secure supply chains.

Stock Performance Overview

Nvidia’s shares have significantly outperformed the broader market. Year-to-date, the stock has risen by 34.86%, in contrast to the Nasdaq Composite’s 17.03% and the Nasdaq 100’s 17.47%. Recently, Nvidia’s stock closed at $186.52, up 2.85% in regular trading and experiencing an additional surge of 5.08% in after-hours trading. Over the past year, Nvidia shares have increased by 27.85%.

As the market continues to evolve, scrutiny over Nvidia’s buyback strategy will likely persist, particularly from prominent investors like Burry. It remains to be seen how these factors will shape the future landscape of shareholder value at Nvidia.