Nvidia Denies AI Bubble, Investors Currently Concur

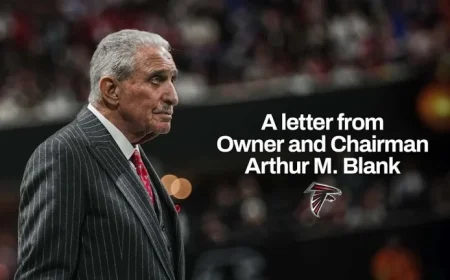

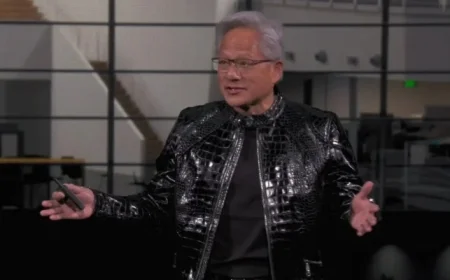

Nvidia CEO Jensen Huang recently addressed concerns regarding an AI bubble during the company’s earnings call. He presented impressive financial results, including a quarterly revenue of $57 billion and a forecast of $65 billion. His statements initially boosted Nvidia’s stock by over 6% in after-hours trading.

Nvidia’s Earnings Highlights

Nvidia’s numbers resonate significantly with market analysts and investors. Revenue has surged by 62% year-over-year, primarily driven by data-center sales that reached approximately $51.2 billion. Additionally, gross margins approached 75%, and the company’s guidance exceeded market expectations by $4 billion.

Analysts Reassess Earnings Forecasts

- Wedbush analyst Dan Ives dubbed it a “monster quarter” and raised the target price to $230.

- BNP Paribas echoed positive sentiment, stating fears of an “AI infrastructure bubble” are overblown.

Despite these robust metrics, traditional market behavior showed volatility, as Nvidia’s stock fell nearly 3% by Thursday afternoon. This reaction reflects ongoing market concerns under the surface, hinting at unresolved anxieties despite strong quarterly performance.

AI Demand and Infrastructure Challenges

The core discussion revolves around whether the growth in AI is sustainable. Nvidia noted that its supply is effectively committed for the next two years, illustrating a 63% sequential jump in supply commitments. This demand is critical as companies scramble for resources in a competitive market.

Market Sentiment on AI Pricing

Analysts expressed mixed feelings about AI’s long-term viability. David Wagner, from Aptus Capital Advisors, emphasized that while Nvidia’s earnings solidify the ongoing AI capex boom, broader market concerns persist. These include issues related to electricity supply and infrastructure capabilities which may hinder future growth.

Infrastructure and Future Prospects

Experts caution that Nvidia’s ambitious projections rely heavily on robust electricity infrastructure. Yvette Schmitter, from Fusion Collective, pointed out potential delays in electricity supply and grid capacity. Kevin Cook from Zacks Investment Research reiterated, “You can’t keep scaling models without scaling electricity.”

Conclusions on Nvidia and AI Bubble Talks

While Nvidia continues to showcase strong numbers, it does not eliminate concerns regarding potential market volatility. Analysts observe that a concentration of performance among a limited number of companies remains a fragile aspect of the market. The narrative surrounding an AI bubble persists, though it has been pushed further back by Nvidia’s recent results.

In conclusion, Nvidia’s growth underscores the real demand for AI technologies. However, market participants will remain cautious amidst infrastructural challenges and evolving economic conditions. The next steps for Nvidia and the broader AI industry will be closely monitored as they navigate these complexities.