Nvidia Shares Drop as Foxconn Confirms $1.4B Data Center Date

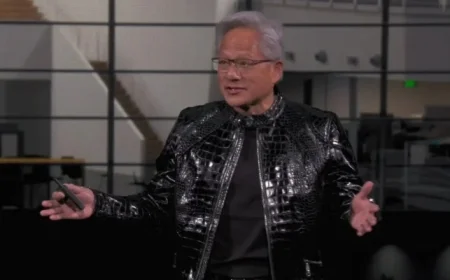

On Friday, Nvidia (NVDA) experienced a decline in its stock value. This drop followed Foxconn’s announcement regarding the timeline for their $1.4 billion data center project. Foxconn confirmed that the supercomputing cluster, being constructed for Nvidia, is slated for delivery within the first half of 2026.

Details of the Data Center Project

This substantial data center project, with a capacity of 27 megawatts, was disclosed by Nvidia CEO Jensen Huang in May. The project is a collaboration between Foxconn and the Taiwanese government. Notably, the facility will utilize Nvidia’s cutting-edge GB300 NVL72 system, integrating advanced Blackwell Ultra graphics processing units alongside the Grace central processing unit.

Impact on Chip Manufacturing

Nvidia anticipates leveraging this data center to enhance its chip manufacturing processes. It plans to rely on its long-term manufacturing partner, Taiwan Semiconductor Manufacturing Company (TSMC), to maximize efficiencies. Additionally, the supercomputing cluster is expected to significantly bolster Taiwan’s AI infrastructure.

Foxconn’s Expansion into AI

- Foxconn is known for manufacturing Apple’s iPhones.

- The company is diversifying its operations to include AI data centers and electric vehicles.

- AI-related products account for 42% of Foxconn’s revenue.

Foxconn has positioned itself as a pivotal supplier of systems powered by Nvidia. These systems are essential for training and operating large AI models.

Nvidia’s Financial Performance Amid Stock Decline

The news from Foxconn arrives as Nvidia’s stock continues to slide. This is occurring despite the company reporting impressive third-quarter earnings, which generated positive reactions from both Wall Street and governmental sectors. The stock’s downturn reflects growing apprehension among investors regarding inflated valuations and potential risks associated with the AI sector.

Analyst Outlook

Despite recent stock fluctuations, Nvidia holds a “Strong Buy” consensus rating on Wall Street. This assessment comes from 40 analysts and is comprised of 38 Buys, one Hold, and one Sell over the past three months. The average price target for NVDA stands at $255.63, suggesting an estimated 42% upside from its current trading price.

Investors continue to monitor Nvidia closely as the dynamics within the AI and tech sectors evolve.