$150 Billion Liquidity Surge Poised to Impact Markets

The financial markets stand on the brink of significant change as a liquidity surge of $150 billion is poised to impact various sectors. This influx, providing ample funds, creates a wave of opportunities for investors.

The Liquidity Surge: Key Details

This substantial increase in liquidity has raised questions about its ramifications on market trends and economic stability. Here are the essential facts surrounding this surge:

- Amount: $150 billion

- Impact: Potential shifts in investment strategies and market trends

- Focus: Long-term growth potential for investors

Market Reactions and Predictions

The $150 billion liquidity boost is expected to affect various investment classes and trading behaviors. Investors and analysts have begun to assess how these changes could influence:

- Stock Prices: Increased liquidity may lead to higher stock valuations.

- Interest Rates: Market conditions could provoke changes in interest rates.

- Currency Movements: Increased funds may also influence currency exchange rates.

How Investors Can Prepare

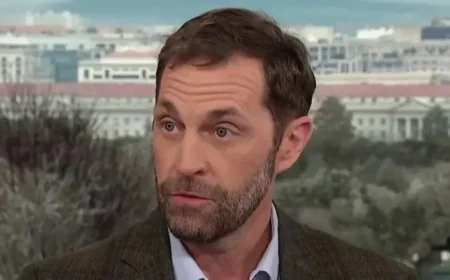

With the anticipated changes, investors should stay informed and adopt strategic approaches. Engaging with educational platforms and expert analysts can provide valuable insights into navigating this evolving landscape.

- Daily Analysis: Subscribing to platforms that offer ongoing market commentary.

- Macro Trend Education: Understanding broader economic indicators that affect investments.

- Community Engagement: Participating in discussions to share insights and strategies.

As this liquidity surge unfolds, remaining adaptable and informed will be crucial for effectively leveraging new market opportunities. Investors should monitor developments closely and adjust their strategies to align with this significant financial event.