California Utility Profits Plummet Amid High Electricity Bills

California’s utility sector is bracing for significant changes as the state’s Public Utilities Commission moves to reduce electric companies’ return on equity rates. This follows the backdrop of soaring electricity bills for consumers, which have made California’s electricity rates the second-highest in the United States, just behind Hawaii.

Proposed Change to Return on Equity Rates

The California Public Utilities Commission (CPUC) has recommended a decrease in the return on equity for major investor-owned utilities, including Pacific Gas and Electric (PG&E), Southern California Edison, and San Diego Gas & Electric. The proposed reduction is 0.35%, bringing potential returns for 2024 to just below 10% for each utility.

- PG&E: Proposed return of 9.93%, down from 10.28%

- Southern California Edison: Proposed return of 9.98%, down from 10.33%

- San Diego Gas & Electric: Proposed return of 9.88%, down from 10.23%

Impact on Shareholders and Ratepayers

Utilities argue that decreasing return rates could hinder their ability to attract crucial investments necessary for infrastructure improvements. Critics, however, suggest that the proposed reduction is minimal and unlikely to create substantial savings for consumers.

Mark Ellis, a former chief economist at Sempra, noted that many state utility commissions set return rates significantly higher than necessary. This approach raises concerns regarding the burden on ratepayers while benefiting utility shareholders.

Context of Electricity Rates in California

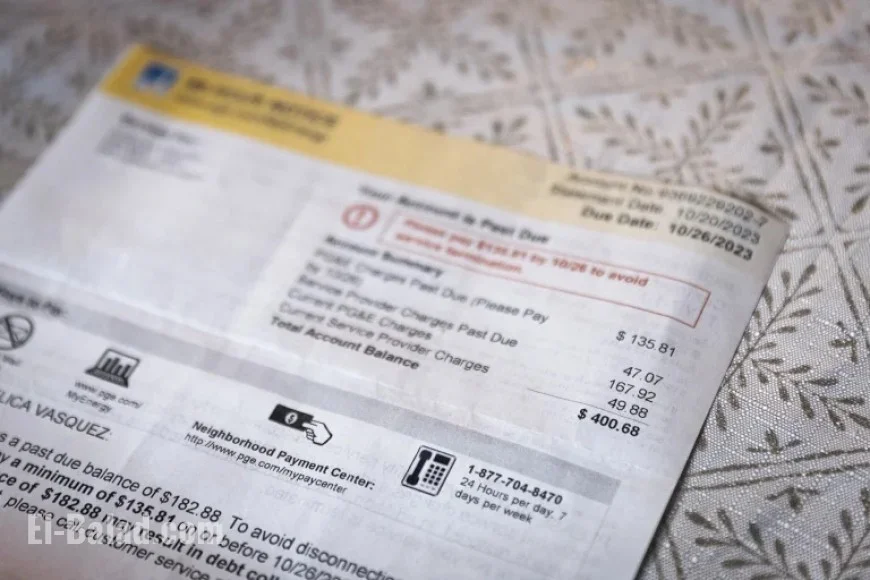

California has faced challenges in managing electricity costs, primarily due to wildfire mitigation expenses and other operational costs. These factors, combined with frequent rate hikes by PG&E, have resulted in consumer dissatisfaction.

According to the U.S. Energy Information Administration, California’s electric rates consistently rank as some of the highest in the nation. This reality has prompted discussions about how to balance shareholder returns with fair pricing for consumers.

Future Steps and Considerations

The CPUC is set to vote on the proposed changes in December 2023. Utilities are urging the commission to reconsider how these rates reflect the unique risks and market conditions in California.

Experts suggest that a reevaluation of the debt-equity balance, rather than solely high shareholder returns, could provide a fairer approach that protects both consumer interests and utility credit ratings.

As the utility sector braces for this potential shift, the focus remains on ensuring a reliable and affordable electric grid for California residents while navigating the complexities of investor expectations and operational costs.