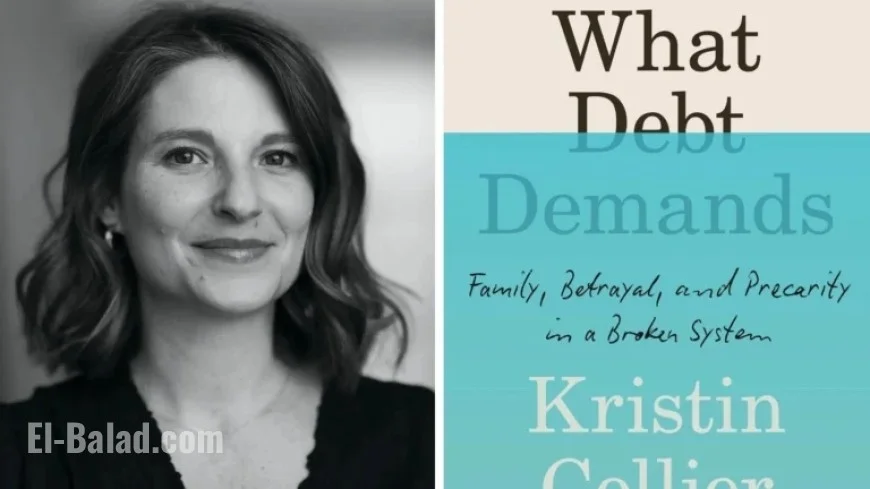

Author Unveils Fraudulent Debt in Student Loan System in New Book

Kristin Collier’s new memoir, *What Debt Demands: Family, Betrayal, and Precarity in a Broken System*, uncovers the dark side of student loans. At just 22, Collier discovered she was in debt for over $200,000 due to fraudulent loans her mother took out in her name without consent. This startling revelation not only highlights the issues surrounding the student loan system but also reflects on the emotional impact of debt on young adults.

Understanding the Journey Through Debt

In her memoir, Collier narrates her life-changing experience with student debt. She learned that her mother, beset by a gambling addiction, acquired multiple fraudulent loans and credit cards under her name. These loans were made possible due to the lax regulations in the private student loan sector.

Lessons on Financial Involvement

- Collier expresses a wish to have been more involved in her student loan process.

- She emphasizes the importance of understanding FAFSA and higher education funding.

- Collier advises future students to monitor their credit reports actively.

She believes the system that allows parents to take out loans in their children’s names without oversight is deeply flawed. Collier’s insights shed light on the complexities of navigating student loans and the lack of transparency that often leaves students vulnerable.

The Broader Impact of Student Debt

Collier’s experience is not unique. Many borrowers face overwhelming amounts of debt that affect their health and career choices. During her twenties, she worked multiple jobs while struggling to keep up with loan payments. This constant stress contributed to serious health issues for her, underscoring the connection between financial strain and physical well-being.

Common Experiences Among Borrowers

- Health issues arising from stress related to student debt.

- Career limitations imposed by the need to repay loans.

- Feelings of shame that impact personal relationships.

Collier interviewed various borrowers and found that, while their situations differed—in that many knowingly took out loans—the weight of debt had similar effects on their lives.

A Call for Understanding

Through her memoir, Collier aims to educate those without debt about the burdens borrowers face. She highlights that the current generation of students bears debt not out of irresponsibility, but from a flawed educational financing system.

Hope for Change in the Education System

Collier stresses the need for reform, advocating for an equitable higher education lending system that does not require students to accrue massive debts. She recounts her own journey toward shedding the fraudulent loans, which involved a complex legal battle that only saw resolution years later.

Advice for Current Borrowers

Collier offers practical advice for those grappling with student debt:

- Reach out to federal student aid representatives for guidance.

- Utilize the Public Service Loan Forgiveness program, if eligible.

- Keep precise records of payment history to track progress.

- Engage with organizations like Protect Student Borrowers for updates.

Her story serves both as a personal narrative and a broader commentary on the systemic issues surrounding student loans in the United States.

Conclusion

Kristin Collier’s *What Debt Demands* offers a vital perspective on the complexities of student debt. It not only reveals the personal ramifications of financial obligation but also advocates for urgent reforms to help future generations avoid similar fates. Through her experiences, Collier hopes to foster understanding and inspire change within the system.