US Options Market Faces Challenges with Clearing Concentration Risk

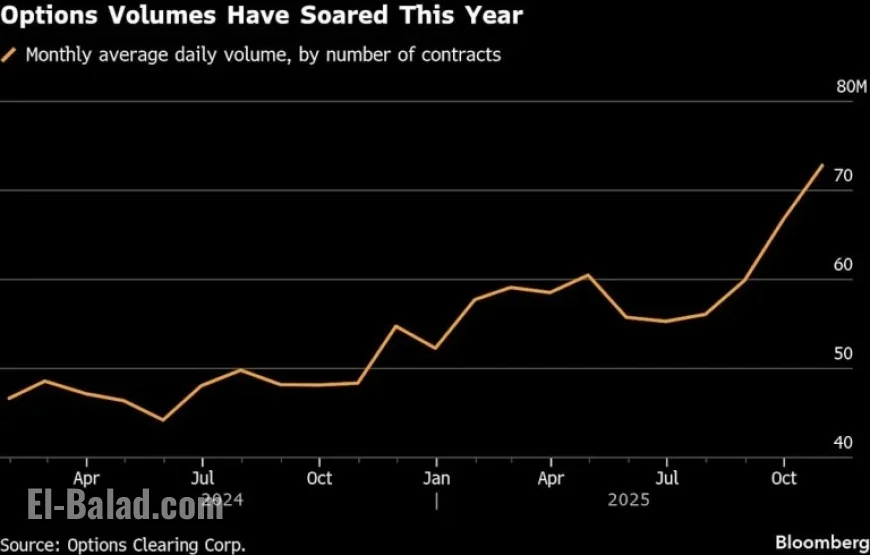

The US options market is approaching a record-breaking sixth consecutive year of heightened trading volumes. However, industry leaders are expressing concerns over the market’s significant dependence on a limited number of banking institutions for trade guarantees. The Options Clearing Corporation (OCC), a central counterparty for U.S. options transactions, processes over 70 million contracts daily during peak times.

Concentration Risk in the US Options Market

Trade submissions to the OCC come from its member firms, who act as guarantors in case of client defaults. Currently, a small group of prominent banks dominates the clearing process, handling nearly half of the OCC’s default fund contributions in the second quarter of 2025. Major players in this space include Bank of America Corp., Goldman Sachs Group, Inc., and ABN Amro Bank NV, managing substantial volumes from market makers.

Potential Consequences of Bank Failures

The concentration of trades among a few firms raises serious concerns about systemic risks if one of these banks were to fail. Craig Donohue, CEO of Cboe Global Markets, has noted significant risks associated with this concentration. Although the failure of a major bank is improbable, the repercussions could be severe.

Donohue cites personal experiences with clearing member defaults, referencing the 2011 bankruptcy of MF Global during his tenure at CME Group Inc. The more pressing concern is the capacity of these financial institutions to manage the explosive growth of the listed derivatives market, with an impressive 52% increase in OCC’s average daily volume in October compared to the previous year.

Shift Towards Self-Clearing

As banks face mounting pressures, market makers are increasingly opting for “self-clearing.” This shift allows them to become direct members of the clearing house, which introduces additional risks due to their typically lower capital reserves compared to banks.

The Challenge of Cross-Margining

Only a few clearing agents possess the capability to manage cross-margining between futures and options. This process enables traders to offset opposing positions in related instruments, effectively minimizing the required margin. For instance, a trader holding long positions in S&P 500 E-Mini Futures and short positions in S&P 500 Index Options might benefit through reduced risk calculation.

Regulatory Complexity

The US regulatory framework complicates matters. Banks fall under the oversight of the Federal Reserve, while broker-dealers and the options market are monitored by the Securities and Exchange Commission. Futures are under the jurisdiction of the Commodity Futures Trading Commission. Consequently, regulations can lead to discrepancies, where a bank may offer cross-margin benefits for clients while simultaneously needing to reserve additional capital for potential liabilities.

Emerging Trends and Additional Costs

The surge of zero-day-to-expiry options and increased retail trading activity present new hurdles for clearing members. An expansion to 24/7 trading could strain the existing clearing system, creating barriers for new entrants. Banks, such as Bank of America, have already adjusted their options clearing fees, increasing charges from $0.02-$0.03 to $0.04 per trade.

Potential Changes to the Default Fund

The OCC is exploring revisions in how it computes each member’s contributions to its $20 billion default fund. This fund is crucial for protecting members in case of simultaneous defaults by two major clearing firms. Currently, contributions are primarily based on a member’s ability to handle routine market fluctuations. However, OCC is seeking approval to incorporate more severe scenarios, such as those seen during the 1987 market crash.

In conclusion, the ongoing discussions surrounding clearing practices highlight an important aspect of maintaining stability within the US options market. As industry leadership pushes for increased competition and enhanced capacity among clearing members, the focus remains on securing the operational integrity of the derivatives trading environment.