Bitcoin drops as December opens: BTC price in USD sinks below $88,000 amid risk-off wave and DeFi jitters

Bitcoin drops sharply to start the month, with BTC price in USD sliding below $88,000 on Monday after a turbulent overnight session. The move spilled across the crypto complex—Ether, XRP, and Solana fell in tandem—while broader risk assets wobbled. The selloff follows a month of heavy volatility and arrives alongside thin liquidity conditions that can magnify intraday swings.

BTC price USD: where it stands and how we got here

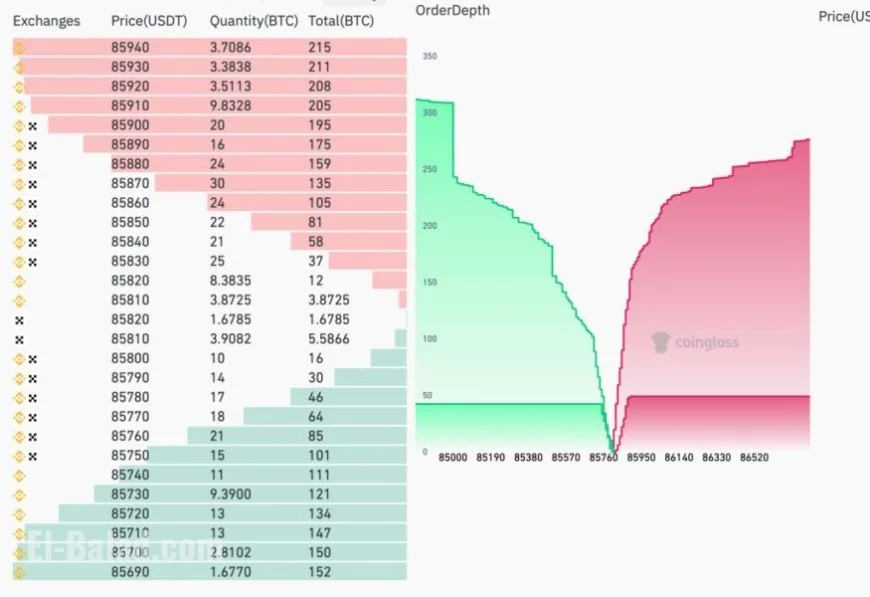

Spot readings during early U.S. premarket hours showed bitcoin fluctuating in the mid-$86,000 to $88,000 range, after tagging intraday lows near $86,000. The drop accelerated after a DeFi incident connected to a Yearn Finance liquidity pool rattled sentiment, with traders parsing potential spillovers to wrapped assets and on-chain liquidity. While technicals had already weakened through late November, the additional uncertainty appeared to catalyze a quicker slide.

Derivatives metrics pointed to a flush of leveraged longs during Asia trading. Estimates indicated hundreds of millions of dollars in long liquidations within hours, with high concentrations on major venues. Such cascades often push price briefly below obvious support before stabilizing as forced selling abates.

Crypto news drivers behind the bitcoin drops

-

On-chain shock: An incident involving Yearn’s yETH pool triggered concerns over token minting mechanics and pool integrity. Even if direct BTC exposure is limited, cross-market contagion is common when confidence in DeFi plumbing wavers.

-

Macro tone: The opening days of December carry a loaded U.S. data calendar and fresh central-bank signaling risk. When growth and policy trajectories feel uncertain, traders frequently de-risk high-beta assets first, including crypto.

-

Liquidity & positioning: Post-month-end order books tend to be thinner. With funding rates having cooled from earlier peaks, the market was more vulnerable to a momentum break and liquidation cascade.

-

Technical context: After failing to reclaim the $92,000–$95,000 zone convincingly, BTC broke below $90,000—an area many short-term traders watched as a pivot—inviting algorithmic and discretionary selling into $87,000–$88,000 and beneath.

Key BTC levels to watch

| Zone | Why it matters |

|---|---|

| $90,000–$91,000 | Lost support; reclaim would signal stabilization and reduce near-term downside momentum. |

| $87,000–$88,000 | Intraday congestion; a hold here could form a short-term base. |

| ~$86,000 low | Overnight nadir; repeated tests risk deeper stops below. |

| $94,000–$95,000 | Resistance band from late-November supply; breakout needed to restore bullish structure. |

These areas are guideposts, not guarantees. Fast markets can overshoot levels, especially when liquidations and spread widening intersect.

How the rest of crypto is reacting

The bitcoin drops narrative is mirrored across majors. Ether slipped through $2,900 on the day before bouncing, with DeFi-related anxiety weighing disproportionately. High-beta layer-1s typically amplify BTC moves; that pattern reappeared as Solana underperformed during the morning downdraft. Stablecoin liquidity pools remained orderly overall, but on-chain spreads briefly widened around the DeFi headlines.

What could steady the tape—or prolong the slide

Paths to stabilization

-

A clear, bounded post-mortem on the DeFi incident that limits broader implications.

-

Short-covering once liquidation pressure fades, particularly if spot demand emerges near $86,000–$87,000.

-

Softer macro prints that revive the “policy support” narrative and ease real-yield headwinds.

Risks to the downside

-

Additional on-chain exploits or cross-protocol knock-ons eroding confidence.

-

Another wave of forced unwinds if BTC loses $86,000 decisively and liquidity thins into U.S. hours.

-

Hawkish macro surprises that extend the risk-off tone beyond crypto into equities and credit.

BTC price USD snapshot for traders and readers

-

Spot range today: roughly $86,000–$88,000 after a swift overnight drop.

-

Intraday low: near $86,000.

-

24-hour context: A broad crypto selloff with long liquidations clustering during early Asia trading.

-

Market tone: Fragile; bounces are possible but likely choppy while the market digests DeFi headlines and macro uncertainty.

Strategy takeaways in a choppy market

For active participants, the playbook remains pragmatic: respect volatility, scale risk to account size, and avoid chasing moves immediately after liquidation spikes. Short-term traders often wait for confirmation—such as a sustained reclaim of $90,000 on rising spot volume—before leaning into longs. Medium-term investors may prefer to let the market define a base and watch whether on-chain flows, funding, and breadth stabilize.

For readers tracking crypto news more broadly, the immediate focus is whether bitcoin can hold the mid-$80,000s and rebuild a constructive pattern into key data later this week. Recent updates indicate the situation is evolving; details around the DeFi incident and any further liquidations may change intraday. As always, crypto markets are highly volatile, and prices can move significantly within short windows.