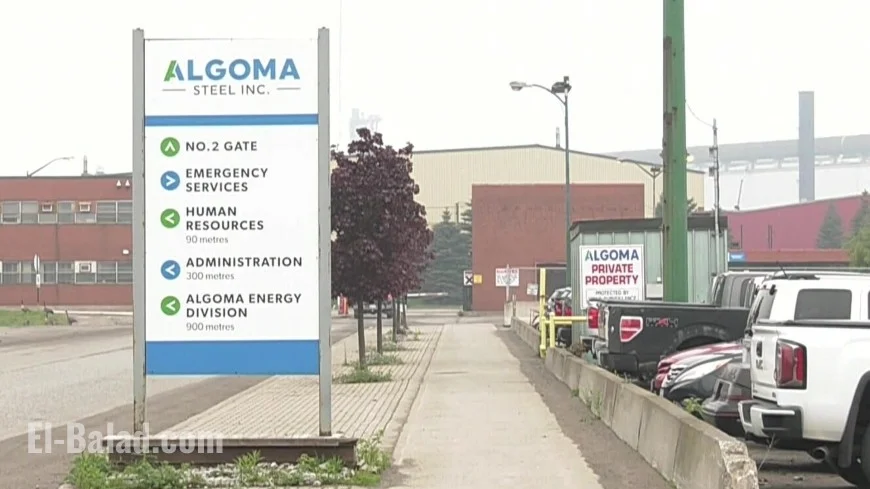

Algoma Steel layoffs: about 1,000 notices go out as tariffs bite and blast furnace era winds down in Sault Ste. Marie

Algoma Steel has begun issuing roughly 1,000 layoff notices, a move the company links to heavy U.S. tariff pressure and the final phase of its transition away from blast furnace and coke-making operations in Sault Ste. Marie, Ontario. Notices state that job losses are slated to take effect in 16 weeks—late March 2026—giving employees a window to plan as the mill accelerates the shift to electric arc furnace (EAF) steelmaking.

What changed today

-

Layoff scale: About one-third of the workforce is affected, based on union tallies and prior headcount disclosures.

-

Effective date: Notices point to March 23, 2026 as the target date for separations.

-

Operations impacted: The company intends to cease blast furnace and coke-making as the EAF complex ramps.

-

Stated drivers: “Unprecedented” U.S. steel tariffs restricting access to the core export market, plus structural changes as the plant retools.

Local officials said employment services and rapid-response teams are being mobilized, with briefings for affected families beginning this week.

Why Algoma Steel is making the cuts

Two forces are converging:

-

Trade shock: Elevated U.S. import tariffs have raised direct costs and choked margins on cross-border shipments, which historically made up a large share of Algoma’s volumes.

-

Technology pivot: The company’s multi-year project to replace the blast furnace with EAF steelmaking is reaching the stage where legacy shops are scheduled to shut. EAFs melt scrap and iron units using electricity, cutting emissions and fixed costs but also reducing labor intensity compared with traditional integrated flows.

Company materials circulated this year highlighted expected benefits of the EAF build—lower carbon output, more flexible production, and a tighter match between steelmaking and rolling capacity—while acknowledging productivity gains mean fewer jobs per ton.

Who is affected—and how

Union leaders estimate around 900 union positions are covered by the notices, with salaried roles accounting for the balance. Notices do not always translate into immediate exits; some workers may be redeployed into EAF and finishing operations, construction support, maintenance, or retirement pathways. Still, given the permanent closure of coke and blast-furnace assets, net employment will fall without offsetting growth elsewhere on site.

What workers should watch for next:

-

Bumping and redeployment language in collective agreements.

-

Bridging options for those nearing retirement eligibility.

-

Reskilling slots tied to EAF operations, electrical/instrumentation, and high-voltage systems.

-

Severance and benefits specifics, which can vary by classification and tenure under Ontario law.

What the timeline looks like

-

Now–January: Individual meetings, redeployment offers where available, and training assessments for roles linked to the EAF ramp.

-

February–March: Final confirmations of positions and schedules; expanded job-matching with regional employers.

-

March 23, 2026: Target effective date for the bulk of layoffs tied to the blast-furnace wind-down.

-

Early–mid 2026: EAF production scales, coke and blast-furnace areas go dark, and staffing stabilizes around the new flow.

Municipal agencies say they are coordinating apprenticeship seats, skilled-trades upskilling, and small-business supports for households facing income shocks.

What this means for Sault Ste. Marie

The mill remains the city’s economic anchor, so a reduction of this magnitude will ripple through contractors, logistics, retail, and housing. The EAF project itself continues to support construction and commissioning jobs, and once fully online, the facility is expected to operate with lower energy and carbon costs—an advantage for long-term competitiveness. In the near term, however, the local priority is income continuity for affected families and bridge funding for community services.

The bigger steel picture

North American steel is deeply integrated. When tariffs rise sharply, Canadian producers face price and access hurdles just as capital-intensive transitions demand steady cash flow. Algoma’s move underscores the sector’s pivot toward scrap-based EAFs, which can ramp and idle more nimbly but employ fewer workers in primary steelmaking. The policy debate ahead will center on whether transitional support—loans, procurement preferences, grid investments—can preserve a globally competitive, lower-carbon mill while softening labor impacts.

What to watch next

-

Final headcount math: How many workers accept redeployment or retirement versus separation.

-

Training pipeline: Uptake of EAF-relevant certifications (high-voltage, automation, ladle metallurgy, environmental systems).

-

Support packages: Details on severance, work-sharing, and temporary income supports.

-

Market signals: Any change in tariff policy or steel pricing that could alter the cadence of cuts.

Algoma Steel’s roughly 1,000 layoffs mark a painful but long-telegraphed turn as the company closes its blast furnace era and completes the shift to electric arc steelmaking. The transformation may strengthen the mill’s future economics, but the human and local impacts will be immediate—demanding a rapid, coordinated response to keep skilled families rooted in the Sault while the plant’s next chapter takes shape.