Proof Shows Higher Costs and Less Value This Shopping Season

As the holiday shopping season unfolds, recent reports indicate that this year’s shopping events could offer higher costs and less value for consumers. According to Mastercard, US retail sales grew by 4.1% on Black Friday, while Adobe Analytics recorded a surge of 9.1% in online shopping. Salesforce forecasts a similar trend for Cyber Monday, with a projected increase of 4% in sales.

Key Trends in Holiday Spending

Despite the growth in sales, significant underlying issues remain. Consumer spending has risen, but this comes with a disturbing trend. Salesforce notes a 3% overall increase in online shopping for Black Friday, driven primarily by a rise in average selling prices, which jumped by 7%. In contrast, the volume of orders decreased by 1% compared to last year.

Additionally, shoppers are putting fewer items in their carts, with units per transaction falling by 2%. “Consumers are paying more per item than last year, but this hasn’t deterred them from spending,” said Caila Schwartz, director of consumer insights at Salesforce.

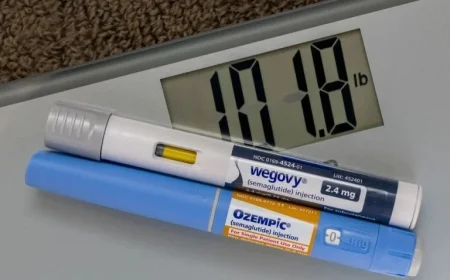

Impact of Tariffs on Shopping

The increases in prices during the holiday shopping period can be partly attributed to historic tariff hikes. According to The Budget Lab at Yale, tariffs imposed by the Trump administration have reached levels not seen since 1935. Categories such as home goods experienced remarkable price increases, with online average selling prices rising by 24% on Black Friday.

- Furniture: Prices increased due to tariffs on imports from Vietnam, Indonesia, and India.

- Clothing: Saw a 6% price increase.

- Electronics: Experienced a 7% rise in prices.

Schwartz mentioned that certain consumer preferences are shifting towards higher-priced categories like luxury items and home goods.

Shifting Consumer Behavior

As the economy faces challenges, spending patterns vary significantly across income levels. Lower-income households, particularly those earning less than $50,000, reported plans to spend $651 on holiday gifts, a drop from $776 last year. Middle-income consumers are also tightening their belts, with expected spending down to $847 from $902.

In contrast, high-income households anticipate spending $1,479, up from $1,403. This divergence highlights a K-shaped economy, where affluent consumers continue to splurge while others pull back.

Price Sensitivity and Future Projections

Salesforce’s data highlights that consumers remain highly price-sensitive. Discounting has played a crucial role in driving demand over the shopping weekend, leading to a 2% rise in order volume on Saturday and Sunday. Overall sale growth for this period reached 5%.

Looking ahead, Salesforce projects $13.4 billion in US online shopping sales for Cyber Monday, representing a 4% increase from last year. The deepest discounts are anticipated for:

- Home goods: 26%

- Health & beauty: 35%

- Clothing: 37%

Consumers continue to face challenges with rising prices, but heavy discounts may encourage spending this holiday season. The degree to which these deals resonate with shoppers remains to be seen.